Advertisement

Advertisement

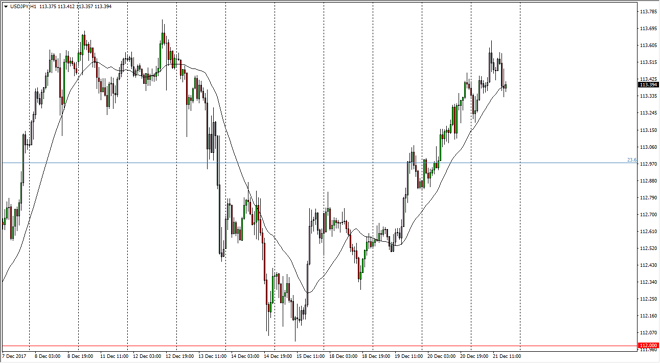

USD/JPY Price Forecast December 22, 2017, Technical Analysis

Updated: Dec 22, 2017, 05:46 GMT+00:00

The US dollar rallied a bit during the trading session on Thursday, reaching as high as 113.65 handle, before pulling back a bit. With less than anticipated GP figures coming out of the United States, we did see a bit of volatility.

The US dollar rallied again during the trading session on Thursday, as we continue to see the market reach towards the upside. With higher interest rates coming out of the United States in, it’s likely that we will continue to see buying pressure in this market, and although the GDP numbers did miss slightly, at the end of the day it looks as if the Federal Reserve will be looking to raise interest rates several times, and of course bonds should start to offer more interest coming out of America as well. At the same time, the Bank of Japan looks very unlikely to be raising interest rates anytime soon or tighten monetary policy for that matter. Because of this, the market should continue to see a lot of volatility, but I believe that will be longer-term traders looking to take advantage of this.

If we can break above the 115 level above, that would be a sign that we are ready to go into more of a “buy-and-hold” scenario, perhaps reaching as high as 1.20 above. I believe that longer-term, that’s exactly what happens, and short-term pullbacks continue to offer buying opportunities. However, expect a lot of noise between now and then, as the market is very sensitive to risk appetite, and many other factors. Geopolitical headlines that are concerning can sometimes send this market to the downside, but as risk continues to build and the stock markets around the world rise, this pair typically will rise right along with them.

USD/JPY Video 22.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement