Advertisement

Advertisement

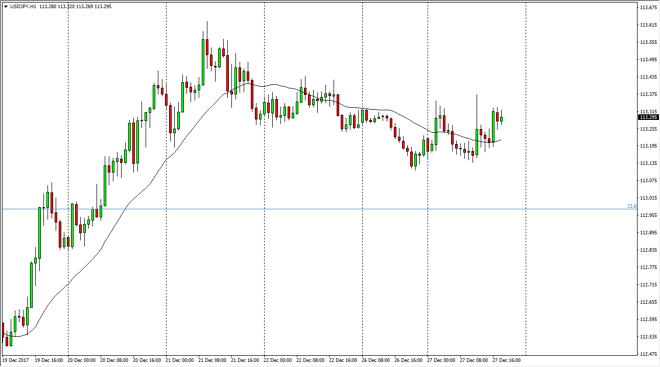

USD/JPY Price Forecast December 28, 2017, Technical Analysis

Updated: Dec 28, 2017, 05:02 GMT+00:00

The US dollar has been very choppy and noisy against the Japanese yen, but quite frankly this is a market that is then, as holiday trading typically is. The 113-level underneath is massively supportive, and I think should continue to offer opportunity to pick up value.

I believe that the US dollar should continue to rally against the Japanese yen given enough time, and of course if there is a bullish attitude of stock markets, it typically sends this market higher. There is a special correlation over time between this pair and the S&P 500, so keep that in mind as well. I think that the market continues to offer value on dips, and even if we were to break down below the 113 handle, I think there is plenty of support at the 112-level underneath which is even more supportive based upon it being the 50% Fibonacci retracement level from the previous movement.

Someday, we will break above the 115 handle and that would be an extraordinarily bullish sign. At this point, I believe it becomes more of a longer-term trend and that buyers will jump into the market and hold on to their positions for the large run up to the 120 handle. I believe the volume needs to return for the market to be reliable though, so keep that in mind, as we will certainly have quite a bit of noise over the next couple of sessions, so keep your position size somewhat small. Eventually, the market will continue to be bullish, but that is probably an argument for January, not this week. You could start to build up a position in small little bits, anticipating the move to the upside. Sometime during the early part of next year, I expect this to become a “buy-and-hold” market.

USD/JPY Video 28.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement