Advertisement

Advertisement

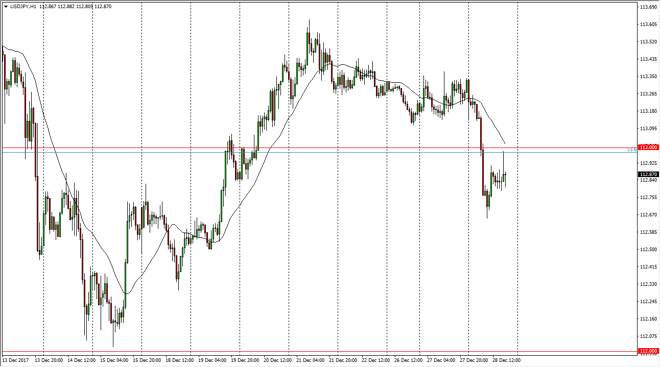

USD/JPY Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:53 GMT+00:00

The US dollar fell significantly against the Japanese yen during the trading session on Thursday, as it is starting to look week against several other currencies in the Forex world. Now that we are below the 113 handle, things have changed just a bit.

The US dollar fell significantly during the trading session on Thursday, breaking below the 113 handle. This is an area that is somewhat significant, but I see even more significance at the 112 level, as it is the 38.2% Fibonacci retracement level of the larger move, and I think that might be where we are getting ready to head. If we can break down below the 112.6 level, it is a “fresh new low”, and should send plenty of selling pressure into the market. However, if we were to break above the 113 handle, the market should then go to the 113.50 level.

Longer-term, I expect that this market will turn around as it is a “risk on” pair, but currently it looks as if the US dollar is getting pummeled against most everything, so it has a certain amount of influence on this pair as well. Pay attention to the stock markets, with particular interest on the S&P 500, as the 2 markets correlate quite nicely. A break above the 115 handle would send this market much higher, giving us more or less a “buy-and-hold” scenario, that could send the USD/JPY pair to the 120 handle. I would expect a lot of volatility over the next several sessions, but ultimately I think that once we get through the New Year’s Day celebrations, we will get enough volume to see in a much more clear manner as to where we are going to go longer term.

USD/JPY Video 29.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement