Advertisement

Advertisement

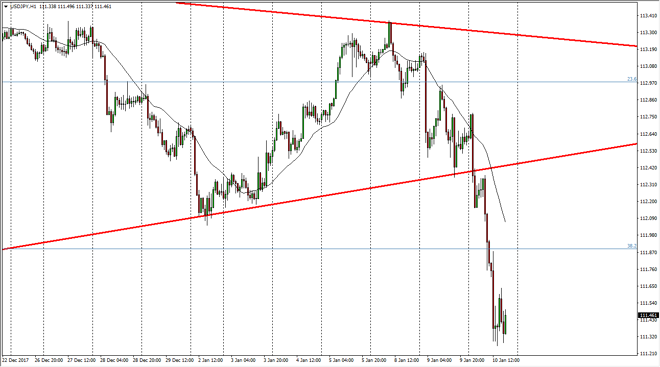

USD/JPY Price Forecast January 11, 2018, Technical Analysis

Updated: Jan 11, 2018, 05:14 GMT+00:00

The US dollar broke down significantly against the Japanese yen during the day on Wednesday, as it appears that there is a possible change of heart by the Bank of Japan as far as quantitative easing is concerned. That has caught the market off guard, sending it down towards the 111.25 level.

The US dollar broke down significantly during the trading session on Wednesday, slicing below the bottom of the symmetrical triangle, and then free fell from there. I believe that the Japanese yen is starting to significantly strengthen overall in the Forex world, mainly because there are concerns and suspicions that the Bank of Japan is going to stand away from the massive quantitative easing that we have seen over the last several years. Historically, the Bank of Japan is always loose with its monetary policy, least since the 1980s, so it’s likely that the attitude will continue longer term, so although we have broken down rather significantly, I believe that it’s only a matter of time before the buyers return.

The 111 level offers a significant amount of support, and I think that if we can stay above that level, the market will probably go looking towards the 112 level again, and then eventually the 113 level. The markets continue to be very volatile, but that’s typical with this pair. I would be very cautious about jumping into the market, but I would do so very slowly because there is so much in the way of volatility just waiting to happen. If we do break down, I believe that the 110 level will be the next support level, which is even more supportive. I think that a lot of this is based upon the idea of guessing where the BOJ goes next.

USD/JPY Video 11.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement