Advertisement

Advertisement

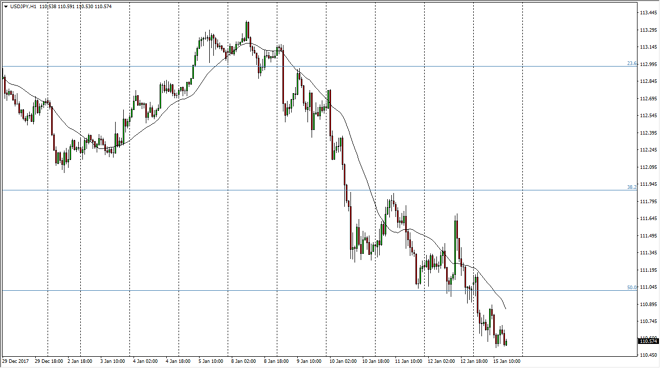

USD/JPY Price Forecast January 16, 2018, Technical Analysis

Updated: Jan 16, 2018, 05:39 GMT+00:00

The US dollar continues to drift lower against most currencies around the world, and the Japanese yen was no different. This is a general “anti-US dollar bias” that we are seeing around the world, so I think it is a situation where we will continue to see rallies attract sellers.

The US dollar has drifted below the 111 level, and reached towards the 110.50 level below where we found a little bit of bullish pressure. The support I think extends down to the 110-level underneath, which is a large, round, psychologically significant number. It is the 61.8% Fibonacci retracement level from the longer-term, and therefore I would expect to see buyers attracted to not only that round number, but the Fibonacci trading signal as well. Because of this, if we break down below the 110 level, I think at that point the market is likely to breakdown rather significantly. In the meantime, I think there’s a lot of volatility that is just waiting to happen, so I like selling rallies in the short term, at least until we break above the 111.70 level.

Overall, I think that we will eventually find buyers underneath, but the 110 level needs to prove itself on a daily chart for me to consider going long. A breakdown below that level will more than likely send the signal much lower, to at least the 108 level. I would become aggressively short of this market at that point, but in the meantime, I think you’re going to see a lot of short-term back and forth trading going forward, and I think that given enough time we will probably see sellers return every time there is a short moved to the upside. I think that the market will continue to be very noisy.

USD/JPY Video 16.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement