Advertisement

Advertisement

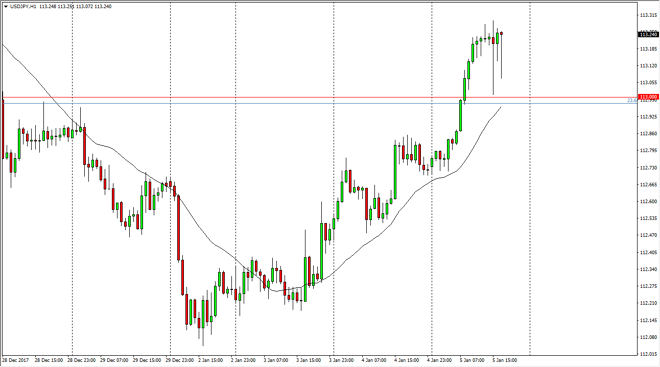

USD/JPY Price Forecast January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:45 GMT+00:00

The USD/JPY pair rally during the trading session on Friday, breaking above the 113 handle. Pulling back from there after the jobs number was only a temporary though, as we have seen plenty of buying.

The US dollar rallied during the trading session on Friday against the Japanese yen, before and after the jobs number. True, the jobs number was weaker than anticipated, but the buyers came back at the vital 113 handle, and found the market interesting enough to get involved. I think we are going to go looking towards the 114-handle next, and then eventually the 114.50 level. Above those areas stands the 115 handle, the gateway to much higher pricing. If we were to break above the 115 handle, it becomes more of a buy-and-hold scenario. Until then, expect volatility and dips occasionally to send this market looking for value.

The market continues to be supported underneath, but I would advise taking small positions and adding as the markets prove your trading position correct. Eventually, once we get a break above the 115 handle, it’s likely that we become more of a “buy-and-hold” market, giving us an opportunity to build a large position between now and then. I believe that there are multiple areas where we are going to see massive amounts of support, not just the 113 handle. After all, it’s likely that there is plenty of support at the 112 handle, and then the 111 level.

This pair tends to be a “risk on” market, meaning that as stock markets rally this pair does as well. Pay close attention to the US stock indices, because there is a certain amount of positive correlation between both this pair and those markets. They are obviously very strong, so I think that continues to put this market in a positive move.

USD/JPY Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement