Advertisement

Advertisement

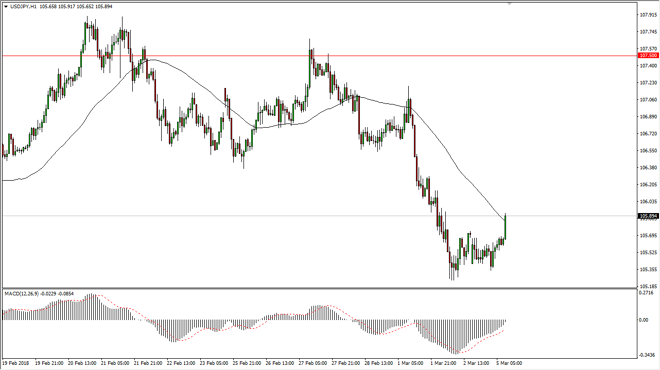

USD/JPY Price Forecast March 6, 2018, Technical Analysis

Updated: Mar 6, 2018, 05:23 GMT+00:00

The US dollar rallied against the Japanese yen during Monday trading as Americans came back to work, reaching towards the 106 handle. This is a very good development, and perhaps a sign that we are trying to see the market form some type of base below.

The US dollar has rallied significantly on Monday, breaking out as the Americans came back to work. This is a very bullish sign, and a potential signal that we are trying to form a bit of a base underneath, based upon the 105 region. If that’s the case, the market could very well reach towards the 107.50 level above, which has been an area that has caused a significant amount of reactions in the past.

Ultimately, the market looks likely to rally from here, if nothing else because we are starting to see a bit of stabilization after the Italian elections offered a hung parliament. In other words, one of the bigger risks that were out there to the financial system seems to have been abated, at least for the time being. Beyond that, bonds are starting to be bought in the United States again, and that of course helps the value of the US dollar. This market tends to be very sensitive to the 10-year treasury market, and if there is more demand for US bonds than there are Japanese bonds, that should continue to drive this market to the upside as well. Ultimately, I believe that the 107.50 level will be very difficult to break but if we do, we could go much higher, perhaps reaching towards the 110 level over the longer term. Alternately, if we were to break down below the vital 105 level, which coincides with a longer-term uptrend line, that would of course be a very negative sign.

USD/JPY Video 06.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement