Advertisement

Advertisement

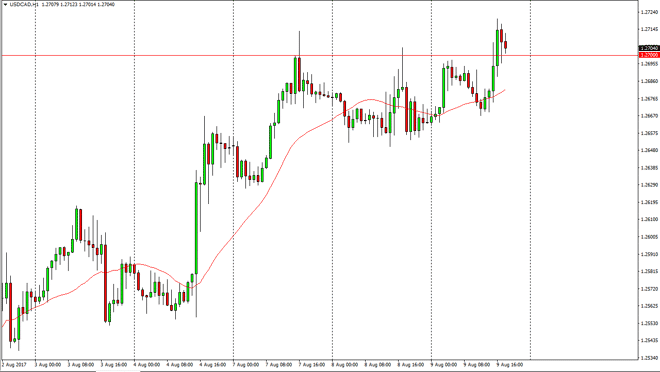

USD/CAD Forecast August 10, 2017, Technical Analysis

Updated: Aug 10, 2017, 06:21 GMT+00:00

The US dollar rallied again against the Canadian dollar on Wednesday, testing the 1.27 level, pulling back, and then breaking through again. To me, looks

The US dollar rallied again against the Canadian dollar on Wednesday, testing the 1.27 level, pulling back, and then breaking through again. To me, looks as if this market is ready to continue rising, and the dips continue to offer buying opportunities. While oil of course has a significant amount of influence on the Canadian dollar, more importantly the strengthening US economy and the belief that the Federal Reserve will continue to raise interest rates later this year has put a damper on what had been the biggest driver of this market: the bond trade. Traders had been buying Canadian bonds in selling American ones, and that of course has massively influenced the flow of currency between the 2 countries.

Buying dips

I continue to buy dips in this market, and believe that we will go looking towards the 1.30 level above. That level will be psychologically significant, and I think that it’s only a matter of time before we try to get there. Ultimately, I believe that there is a massive amount of support near the 1.2650 level, so as long as we can stay above that level, I’m bullish. I think that the US dollar will continue to gain against the Canadian dollar as the Bank of Canada is going to have to worry about the Toronto housing bubble breaking as well. There are too many reasons why this market should go higher, not the least of which is that we have recently bounced from a major uptrend line on the weekly chart. I have no interest in selling, even if we break down below the 1.2650 level, which would only have me reevaluating the entire situation. I believe that the Canadian dollar is about to get pummeled over the next several weeks, if not months.

USD/CAD Video 10.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement