Advertisement

Advertisement

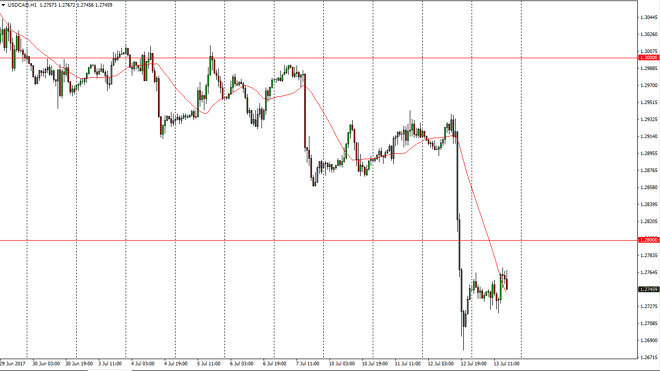

USD/CAD Forecast July 14, 2017, Technical Analysis

Updated: Jul 14, 2017, 05:28 GMT+00:00

The US dollar went sideways during the Thursday session, after a major selloff in reaction to the Bank of Canada raising interest rates on Wednesday. The

The US dollar went sideways during the Thursday session, after a major selloff in reaction to the Bank of Canada raising interest rates on Wednesday. The market is catching its breath, and quite frankly now that we have broken below the 1.28 level I expect this market to go lower. However, a bounce is probably needed to build up momentum, so that we can continue to go lower. Oil markets obviously influence the Canadian dollar, so we could get a lot of noise from that part of the world, but in the meantime, I believe that the bond trade continues to push this pair lower, as Canadian interest rates look set to outpace US interest rates in the treasury markets.

Selling rallies

I believe that selling rallies will continue to be the way going forward, so I’m looking for exhaustive candles to take advantage of “value” in the Canadian dollar. Longer-term, I have serious concerns about Canadian housing, but it appears that the short to intermediate term situation dictates that we go lower. If we broke above the 1.29 level, that would be a catastrophic failure by the CAD, and then I would not only be getting long of the market, but aggressively so. I doubt that’s going to happen though, and technically I think we are setting up for a move towards the 1.26 handle over the next several weeks, if not months.

We are approaching vacation season, so the volume will be a bit of an issue, but it looks as if the sellers are certainly in control overall, so I believe that we will get range bound trading in general, followed by sudden moves lower. Again, I prefer selling rallies as it gives us an opportunity to pick up value.

USD/CAD Video 14.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement