Advertisement

Advertisement

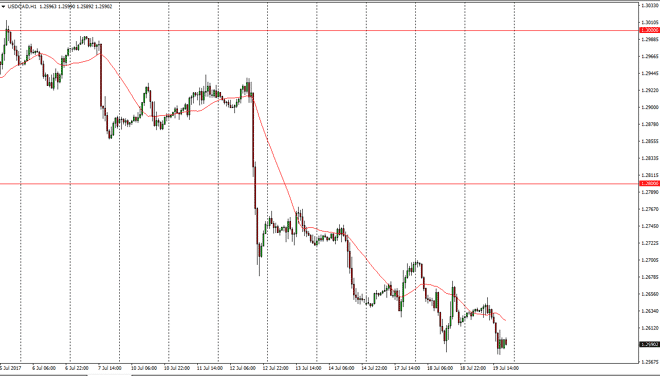

USD/CAD Forecast July 20, 2017, Technical Analysis

Updated: Jul 20, 2017, 06:21 GMT+00:00

The United States dollar fell against the Canadian dollar during the session on Wednesday, as we sliced through the 1.26 handle. There is more

The United States dollar fell against the Canadian dollar during the session on Wednesday, as we sliced through the 1.26 handle. There is more psychologically significant relevance to the 1.25 handle underneath, so I think that’s where we will probably try to go. Short-term rallies should continue to be selling opportunities, and I believe that the market will look at them as such. The bond trade has been favoring Canada for some time, so I think that the market continues to find selling pressure. I don’t know if we can break below the 1.25 handle though, that’s a question for another time. In the meantime, though, it looks like we are most certainly looking to get down there and it of course works with the recent trend that we have seen.

Selling rallies

I was so short-term rallies, for short-term losses in the exchange rate. I think the given enough time, we will test the final 1.25 handle and if we can break below there, things get very ugly and in very quick fashion. If we do rally from here, I think that the 1.28 level will be massively resistive, and essentially the “ceiling” in the market. If we were to break above there, the market could go much higher, but I do not expect that to happen, because quite frankly that would be wiping out some of the losses from when the Bank of Canada raised interest rates. I believe that this market will certainly have a downward bias to it, but oil markets could come into play given enough time. Remember, if oil roles over, it typically sends this market higher, but right now it appears that the bond trade is much more on the minds of traders than petroleum which is already known to be oversupplied.

USD/CAD Video 20.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement