Advertisement

Advertisement

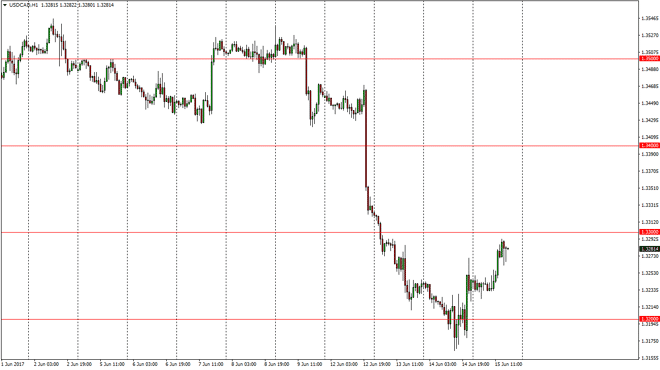

USD/CAD Forecast June 16, 2017, Technical Analysis

Updated: Jun 16, 2017, 04:20 GMT+00:00

The USD/CAD pair initially tried to fall during the day on Thursday, but found enough support to turn around and go looking towards the 1.33 handle. A

The USD/CAD pair initially tried to fall during the day on Thursday, but found enough support to turn around and go looking towards the 1.33 handle. A break above there will be a very bullish sign, suggesting that the market will retrace a lot of the damage done after statements coming out of various Bank of Canada members. Beyond that, oil markets look susceptible to downward pressure, and this should continue to put bullish pressure in this market. The Canadian dollar of course is highly levered to the oil markets, meaning that if oil falls, that should continue to push this market to the upside. I believe that the 1.34 level will be targeted next, and then eventually the 1.35 handle. I recognize that short-term pullbacks may be buying opportunities, but if oil suddenly finds buying pressure, that could turn things around and break this market apart.

Volatility remains

No matter what happens, I believe that volatility will remain in this market, but I believe the buyers will continue to be the more aggressive of the two directions. With this being the case, I am bullish but I recognize that the clearance of the 1.33 level may be needed to build up a little bit of confidence going forward. I believe that the market will probably be volatile, so with that being the case caution will probably be the most important thing you can keep in mind when it comes to the market.

As I record this, the oil markets seem to be rolling over, and that I believe will continue to push to the upside. Ultimately, the market may have overreacted the other day, and now we may be getting ready to see the market correct over the next couple of sessions.

USD/CAD Video 16.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement