Advertisement

Advertisement

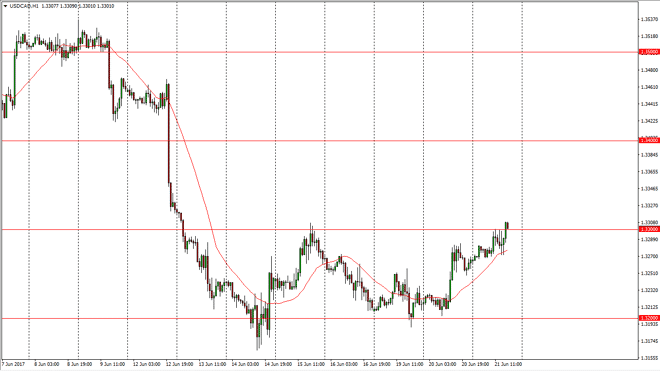

USD/CAD Forecast June 22, 2017, Technical Analysis

Updated: Jun 22, 2017, 04:42 GMT+00:00

The USD/CAD pair went sideways with a slightly upward bias during the day, but as the market broke above the 1.33 level, the market exploded to the upside

The USD/CAD pair went sideways with a slightly upward bias during the day, but as the market broke above the 1.33 level, the market exploded to the upside and continues to feed on the downward pressure in the crude oil markets. I believe that the crude oil markets will continue to struggle as the fundamental picture is simply far too bad. Ultimately, the market continues to favor the downside as shale oil continues to be pumped out at major amounts of crude into the market. I believe that the market should then reach towards the 1.34 handle, and then possibly the 1.35 level above. After all, we have been in an uptrend channel over the longer-term, and therefore I feel that the US dollar will continue to strengthen for not only the reasons and the crude oil market, but also the interest rate outlook for the Federal Reserve.

Lower lows

On the longer-term chart, we have also made a lower low, so that of course is a very positive sign. I believe that the market will course be very choppy, but still have an upward bias. I don’t have any interest in trying to short this market, at least not until we were to break down below the 1.32 handle, which is something that doesn’t seem very likely to happen in the short term. I think that it will be volatile, but that is due to not only the crude oil market, but the strength in the US economy. I think that the uptrend continues to be the main driver the market, so be careful but also be bullish. I believe that adding as we go higher and clear each handle is the best way to go as the market will continue to grind.

USD/CAD Video 22.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement