Advertisement

Advertisement

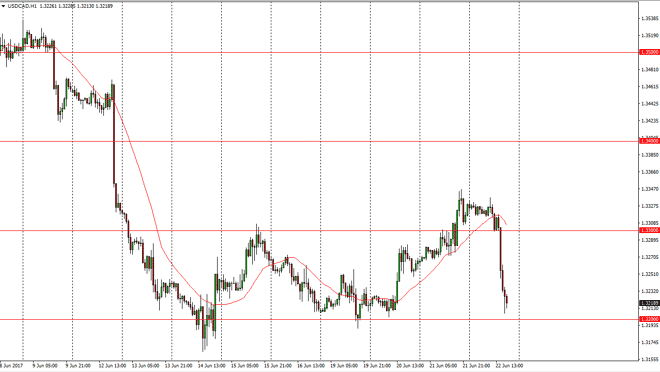

USD/CAD Forecast June 23, 2017, Technical Analysis

Updated: Jun 23, 2017, 03:40 GMT+00:00

The US dollar fell significantly during the day after initially treading water above the 1.33 handle. The Canadian dollar of course is highly sensitive to

The US dollar fell significantly during the day after initially treading water above the 1.33 handle. The Canadian dollar of course is highly sensitive to the oil markets, so it makes sense that we would react according to what goes on in that market. The market looks likely to remain volatile, but as I record this video, it also looks as if the 1.32 level is starting to offer support. Because of this, I’m willing to jump into this market, perhaps aiming for at least the 1.33 handle, and then perhaps even the 1.34 level. Pay attention to the oil markets, because if they start to roll over again, it makes quite a bit of sense that this market will rally as it would favor the US dollar and of course more importantly, punish the Canadian dollar.

Longer-term uptrend

The longer-term uptrend continues to be what I pay attention to, so even though we could break down a bit, I don’t have any interest in selling this market, given enough time, I think that the 1.35 level is an area where the market will be aiming for, and then the 1.4 level above there. I think that the market will continue to see quite a bit of noise, but with this being the case it’s likely that the volatility will shake a lot of you out. I prefer to buy small positions, and simply add every time I find myself passing another handle in the right direction. So, for example, I would be buying a small position in this area, and then add another small position above the 1.33 handle, the 1.34 handle, and so on. Ultimately, the market tends to trend quite nicely over the longer term, and with everything that’s going on with the oil markets, I believe that the longer-term move continues.

USD/CAD Video 23.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement