Advertisement

Advertisement

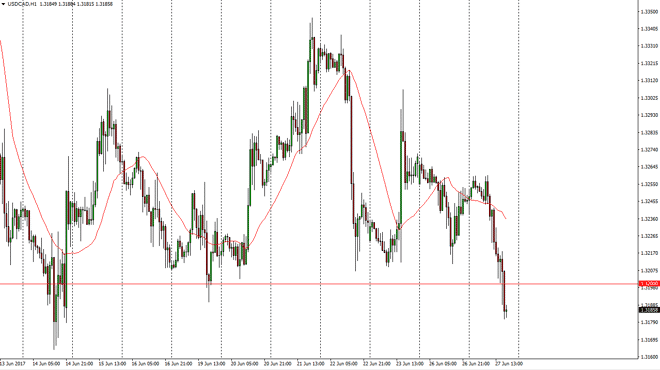

USD/CAD Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:46 GMT+00:00

The US dollar broke apart against the Canadian dollar rather significantly. Ultimately, this is a market that has broken below the 1.32 level, and that

The US dollar broke apart against the Canadian dollar rather significantly. Ultimately, this is a market that has broken below the 1.32 level, and that was an area that was offering a significant amount of support. I believe that the 1.3175 level of course offers a significant amount of support as well, so it’s not until we break down below there that I would be a seller. Some type of rally from here or a break above the 1.32 level would be a bullish sign, perhaps sending the market to the 1.3250 level. Pay attention to the oil markets, the of course have a massive influence on this pair, and that can cause quite a bit of volatility. Oil markets continue to be in focus, and of course today will be a big day.

Crude Oil Inventories

The Crude Oil Inventories announcement comes out of the United States today, and that of course will have a massive effect on what happens in this pair. I believe that the oil markets are bouncing a bit, and that of course is very bullish, but in a short-term sense at best. The $45 level in the WTI Crude Oil market should be massively resistive, so it’ll be interesting to see how we behave once we get to that level. If we roll over at that level, I think the US dollar will strengthen. Alternately, if we break above the $45 level, the market should continue to drop down from there. The pair also should think about the housing market in Canada, which is in a massive bubble. Given enough time, I think the buyers to return but clearly in the short term this market looks very vulnerable to the downside. A break above the 1.3250 level should send this market to the upside, perhaps reaching the 1.33 handle.

USD/CAD Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement