Advertisement

Advertisement

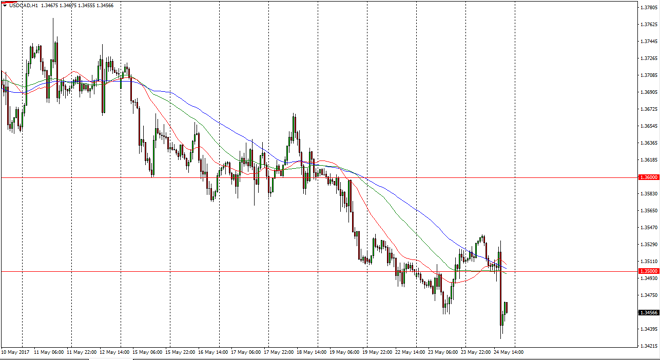

USD/CAD Forecast May 25, 2017, Technical Analysis

Updated: May 25, 2017, 03:48 GMT+00:00

The US dollar bounced around during the session on Wednesday, hovering just above the 1.35 level most of the time. However, later in the day the Bank of

The US dollar bounced around during the session on Wednesday, hovering just above the 1.35 level most of the time. However, later in the day the Bank of Canada suggested that the most recent inflation mess was an anomaly, and not something to be concerned about. Because of this, the market looks likely to favor the Canadian dollar in a situation where oil markets look to be fairly well supported. Quite frankly, as we broke below the 1.36 level, it’s likely that the selling pressure continues to be strong, mainly due to the oil prices. The oil market will more than likely be volatile, as the OPEC announcement comes out later in the day. If the OPEC announcement suggests that the production cuts are longer and deeper than anticipated, that will drive up the price of oil, and by extension drive this currency pair lower.

Selling rallies

I believe that we will continue to sell rallies as the market has made a fresh, new low again during the day, but I also recognize that the oil market will be paramount as to where we go next. After all, if OPEC disappoints the bullish oil traders out there, this market will more than likely turn around and with a quickness. Because of this, this pair could be one of the more interesting currency pairs over the next couple of sessions, as we will see a lot of volume jump in or out of oil pits.

Looking below, I believe that the 1.33 handle underneath should be supportive, and most certainly the 1.30 level under there. Longer-term, I believe that oil has major issues, but in the short term it’s obvious that the buyers have been running this market to the upside, causing the longer-term issue of shale producers in North America to jump in.

USD/CAD Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement