Advertisement

Advertisement

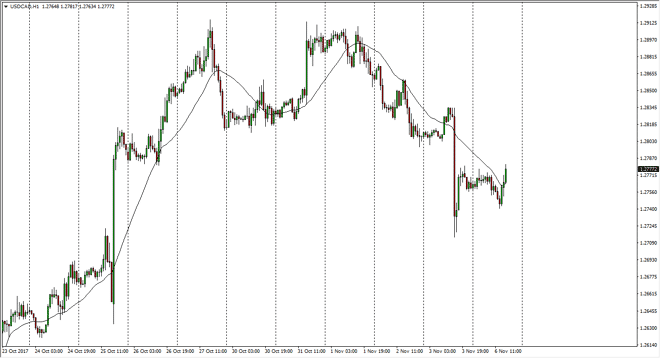

USD/CAD Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 07:00 GMT+00:00

The US dollar went sideways during the session on Monday, showing the 1.2750 level as supportive. With the 24-hour exponential moving average rolling

The US dollar went sideways during the session on Monday, showing the 1.2750 level as supportive. With the 24-hour exponential moving average rolling over, and starting to turn to the upside, I believe that we will continue to see buyers jump into this market. Eventually, we should go looking towards the 1.29 level above, and then eventually after that the 1.30 level. I find this a very interesting market currently, because even with oil markets breaking out to the upside, the Canadian dollar is not picking up strength. This breaks down a significant correlation, and that being the case I think it’s a very strong sign that we are going to go higher over the longer term. Beyond that, I feel that there is a bit of a “risk off” via the coming back into the global financial system, and if that’s the case we should continue to see the US dollar strength in overall.

Even if we were to break down from here, I would be very careful about shorting this pair, because quite frankly I think it’s only a matter of time before the markets turn around. I look at the 1.25 level underneath as the “floor” of the market, and I also recognize that a break above the 1.30 level above would be the next leg higher and should send this market into more of a “buy-and-hold” mode. There is going to be a lot of volatility, but quite frankly I think that the buyers will prevail, not only because eventually oil gets a bit too expensive, but the Federal Reserve looks much more likely to raise interest rates in the short term than the Bank of Canada. Make no mistake, at the end of the day interest rate expectations overrule everything.

USD/CAD Video 07.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement