Advertisement

Advertisement

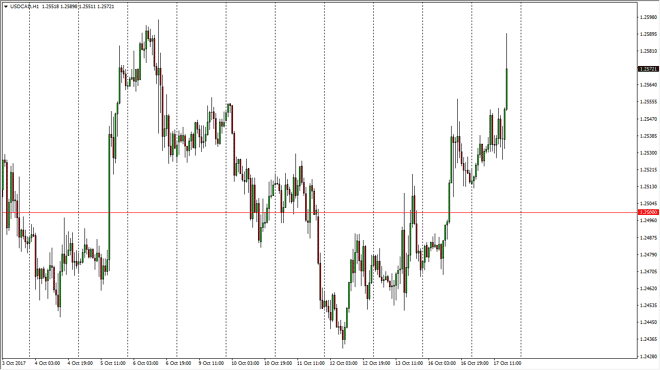

USD/CAD Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 04:54 GMT+00:00

The USD/CAD pair initially went sideways, but then exploded to the upside, reaching towards the 1.26 level. The market pulled back slightly from there,

The USD/CAD pair initially went sideways, but then exploded to the upside, reaching towards the 1.26 level. The market pulled back slightly from there, and I think that there is a lot of support underneath to keep this market going higher, so I look at this pullback as a potential buying opportunity. If we can break above the 1.26 level, the market should then go looking towards the 1.30 level longer term. Keep in mind that the oil market has a certain amount of influence on the Canadian dollar, so if it rolls over, that tends to put upward pressure on this market. Beyond that, we have had a lot of speculation on Canadian bonds, and that trade seems to be unwinding a bit.

The Bank of Canada recently suggested that although there was a surprise interest rate high, that it should be thought of as “automatic” that they will continue. That was the beginning of the end of the Canadian dollar rally, and now I think it’s hard to imagine anything but this market rallying from this point. I also believe that the WTI Crude Oil market has a major resistance level at $55, which should keep this market down. That should give us yet another reason to think that the Canadian dollar will struggle to go higher. That is very bullish for this market, and if the Federal Reserve is looking to raise interest rates several times, it’s very likely that the pair should continue upward. I look at these pullbacks as buying opportunities, and that a “buy on the dips” attitude should continue to be the mainstay of this pair as we have seen so much wherewithal when it comes to the buyers, and I think that the 1.30 level proves to be too enticing for buyers to give up on.

USD/CAD Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement