Advertisement

Advertisement

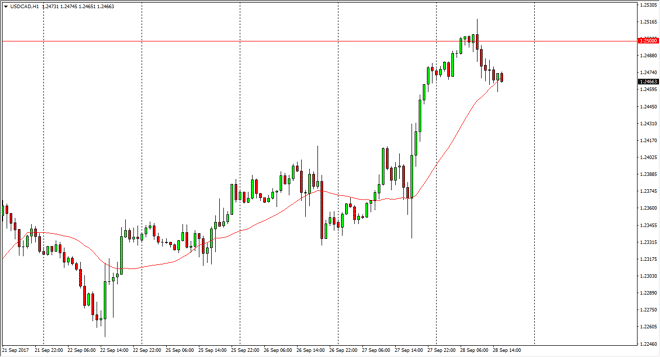

USD/CAD Forecast September 29, 2017, Technical Analysis

Updated: Sep 29, 2017, 05:45 GMT+00:00

The US dollar initially tried to rally against the Canadian dollar, but has found the 1.25 level to be resistive. I think it’s pretty simple from this

The US dollar initially tried to rally against the Canadian dollar, but has found the 1.25 level to be resistive. I think it’s pretty simple from this point, if we can break above the 1.25 level on a daily close, that’s a very bullish sign. Alternately, if we break down below the 1.2425 level, the market then breaks down from there and go as much lower. I believe that the market probably drops down to the 1.23 level next, and beyond. We had recently broken down below a significant uptrend line, and this could signal that the markets ready to roll over again. However, if we turn around and break above the 1.25 level on a daily close, that’s a very bullish sign as it refutes what we have recently seen. That could have this market going much, much higher.

Crude oil

Crude oil has been looking a bit more healthy as of late, and that typically helps the Canadian dollar. However, we are seeing the market fly in the face of that, so I believe that this has more to do with interest rate differentials and of course the bond markets. The bond markets had been buying Canadian bonds in selling US bonds, and this was supercharged when the Bank of Canada came in and raised interest rates suddenly. However, they have sent suggested that they will be very careful about raising rates, and perhaps the market got ahead of itself. Now that we have clear the top of the previous meltdown from the interest rate hike, I believe that there is a real decision to be made here. Pay attention to the next couple of days, this could lead the market in a significant move in one direction or the other.

USD/CAD Video 29.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement