Advertisement

Advertisement

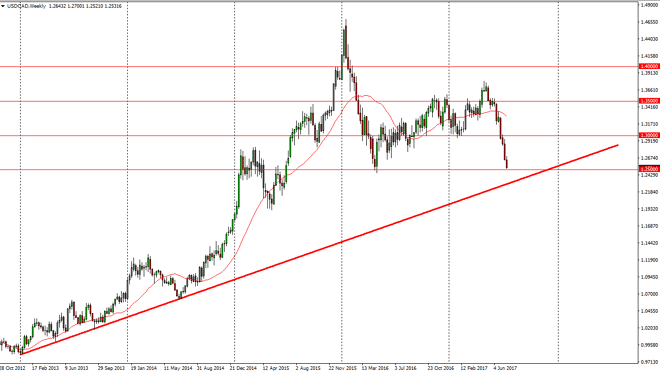

USD/CAD forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:42 GMT+00:00

The USD/CAD pair fell slightly during the week, testing the 1.25 handle. We continue to see a massive downtrend move, but we are getting a bit

The USD/CAD pair fell slightly during the week, testing the 1.25 handle. We continue to see a massive downtrend move, but we are getting a bit overextended. A bounce from the 1.25 level would make a lot of sense, as it is a large, round, psychologically significant number. Regardless, there is a massive uptrend line underneath that could also offer support, closer to the 1.24 handle. As we have fallen so hard, I suspect that it is only a matter of time before we get a bounce, but that bounce is probably something that you can sell. If we were to break down below the uptrend line, that would be very negative and send this market much, much lower. In fact, I believe that the target on a breakdown below the uptrend line would be closer to the 1.15 handle.

Canadian bonds

This is a trade that’s based upon Canadian bonds, or rather the idea that a lot of people are buying them while selling US bonds. This has very little to do with the oil market, but if oil was to roll over, that might disrupt this move. Longer-term, we will have to wait and see whether the uptrend line holds, because if it does it could send the market back into an uptrend but the US dollar is going to need some type of help, be it either a softening oil market, or perhaps somebody in the Federal Reserve suggesting that interest rates are in fact going to be risen just as rapidly as people had thought. Because of this, I believe that the next week or 2 will be vital for where this market goes next. It does look oversold currently though, so I do expect some type of bounce during the week.

USD/CAD Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement