Advertisement

Advertisement

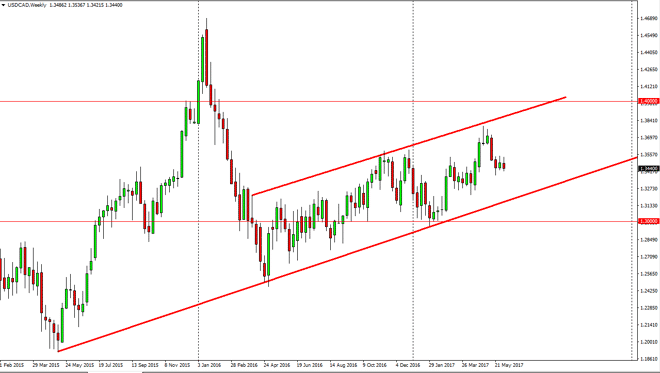

USD/CAD forecast for the week of June 12, 2017, Technical Analysis

Updated: Jun 10, 2017, 04:10 GMT+00:00

The US dollar initially tried to rally against the Canadian dollar during the week, but rolled over a bit as the Friday announcement of a stronger than

The US dollar initially tried to rally against the Canadian dollar during the week, but rolled over a bit as the Friday announcement of a stronger than anticipated hiring of Canadian workers of course worked in favor of the Loonie. Looking at the longer-term charts, I still believe that we have a significant amount of support underneath, but we have not reached it yet. The uptrend channel has not been violated, and I’m waiting to see if we can find support below that we can start buying. Until we reach that level, I would have to think that there is a significant amount of bearish pressure that could get involved, but at the same time we have oil markets that are looking suspiciously soft. A bit of a rally in the oil markets may be coming over the short term, because they are bit oversold, but longer-term we have major issues when it comes to the idea of oversupply.

Buying the dips? Maybe.

I believe that buying the dips will probably be the way to go, but it will course be a very choppy market to deal with. I think the given enough time the market should continue to find buyers, as the uptrend line has been so prevalent and obvious, and I think that the rest of the market participants will look at that as an opportunity to take advantage of an area that looks to be obvious. I think that the 1.40 level above will be a target eventually, but we may have to grind back and forth quite a bit to do so. After all, the oil markets themselves are going to be choppy so this currency pair should be as well. By being patient, you should be able to find value at lower levels.

USD/CAD Video 12.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement