Advertisement

Advertisement

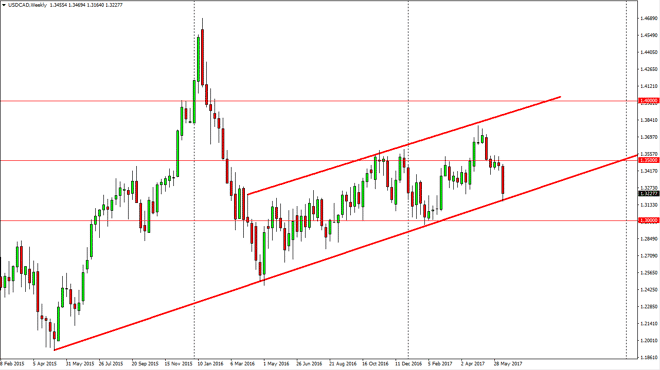

USD/CAD forecast for the week of June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:13 GMT+00:00

The USD/CAD pair fell significantly during the course of the week, slamming into the uptrend line just below. We have been in a decent uptrend in channel

The USD/CAD pair fell significantly during the course of the week, slamming into the uptrend line just below. We have been in a decent uptrend in channel for some time, a little bit over a year. Because of this, and the fact that we found support at the trendline, I believe that the buyers are about to come back into this market. A lot of we have seen has been in reaction to the idea that the Bank of Canada may be looking to tighten monetary policy relatively soon. On the other hand, we already know that the Federal Reserve is looking to raise interest rates, and of course the oil markets are very soft. Either way, that should continue to favor the US dollar over the Canadian dollar, so I believe that this is a nice buying opportunity, and signs of support or a bounce could be a nice buying opportunity.

Pay attention to oil

Oil did rally a bit during the day on Friday, but I think we are facing a significant amount of resistance in that market, and that should turn around rather soon. With this being the case, that should continue to weaken the Canadian dollar, thereby sending this market towards the 1.35 level above. A break above there should send the market towards the 1.37 level, and then eventually the 1.40 level after that. Ultimately, I believe that we continue to grind higher, and I also assume that this uptrend in channel will continue to hold the market in check. If we do breakdown below the bottom of the channel, then we will probably reach towards the 1.30 level underneath. A breakdown below there would be very negative, perhaps reaching down to the 1.28 handle.

USD/CAD Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement