Advertisement

Advertisement

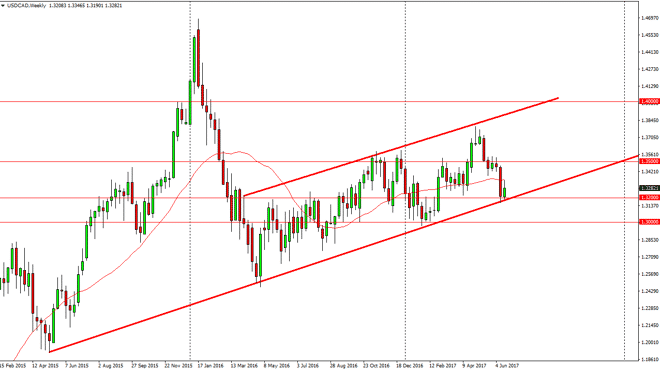

USD/CAD forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:14 GMT+00:00

The US dollar rallied during the week, bouncing off the 1.32 handle, and more importantly the uptrend line from the channel that has been so stringent

The US dollar rallied during the week, bouncing off the 1.32 handle, and more importantly the uptrend line from the channel that has been so stringent over the last year. With the oil markets falling significantly, it makes sense that the US dollar should continue to strengthen if this continues to be the case, as the market should then go to the 1.35 handle. A break above there should continue to send this market towards the 1.37 level. Longer-term, I believe that the Canadian dollar has several issues, not the least of which is a well but you should keep in mind that currency traders tend to use this Canadian dollar market as a proxy for the crude oil markets.

Lots of noise

There is a lot of noise coming out of the Canadian central bank lately, as the various members have suggested that perhaps tightening may be in the near future than anticipated. However, with the housing issues coming out of places like Toronto, it’s difficult to imagine that the Canadian economy is that rock solid. This is also going to be an issue as oil falls, as it is such a large portion of the Canadian economy. Given enough time, I think we simply follow the channel, as they tend to last until they don’t so to speak. The markets I think are going to go looking for the 1.40 level over the longer term, but it may take some time to get there, perhaps even the end of the year possibly. Once we break above there, the markets probably free to go even higher. I believe in a longer-term “buy-and-hold” type of situation, and will continue to do so until this channel as broken down below.

USD/CAD Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement