Advertisement

Advertisement

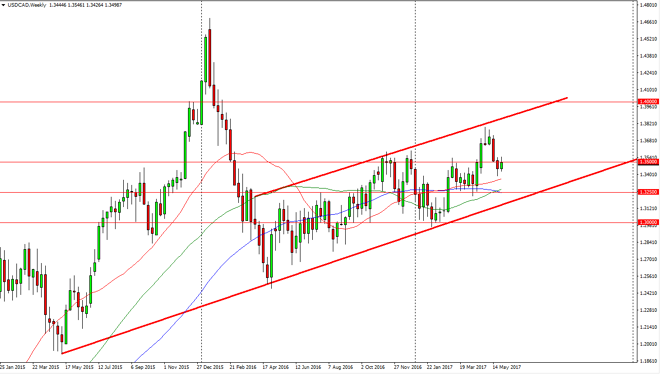

USD/CAD forecast for the week of June 5, 2017, Technical Analysis

Updated: Jun 3, 2017, 01:58 GMT+00:00

The USD/CAD pair had an interesting week, initially breaking above the 1.35 handle, and then rolling back over only to bounce again. I believe that we are

The USD/CAD pair had an interesting week, initially breaking above the 1.35 handle, and then rolling back over only to bounce again. I believe that we are trying to form a little bit of a base just below, but as you can see on the longer-term chart, I also have an uptrend in channel drawn out that could suggest a deeper pullback. Obviously, we have a massive amount of influence coming from the oil markets, which of course have been erratic to say the least. I believe that if oil falls, that should push this market much higher, and I think that will happen given enough time. Having said all of that, we could still drop down to the 1.3250 level and remain in the uptrend in channel rather comfortably. I think the volatility and choppiness continues, so I am going to be very selective about how I get involved into this market.

2 scenarios

If we can break above the top of the shooting star for the week, I believe that the market should continue to go higher, probably reaching towards the 1.350 level next. Alternately, if we break down below the bottom of the candle for this week that has just passed, the market will probably go looking for the 1.3250 level. Longer-term, I still believe in the upside but I also recognize that we may continue the messy grind higher overall, which offers trading opportunities in both directions for those who are nimble enough.

I would say that if the market breaks down, it’s probably to easier to trade this market on short-term charts. Alternately, I moved to the upside should be one that follows the longer-term charts more than anything else. Regardless, expect a lot of noise.

USD/CAD Video 05.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement