Advertisement

Advertisement

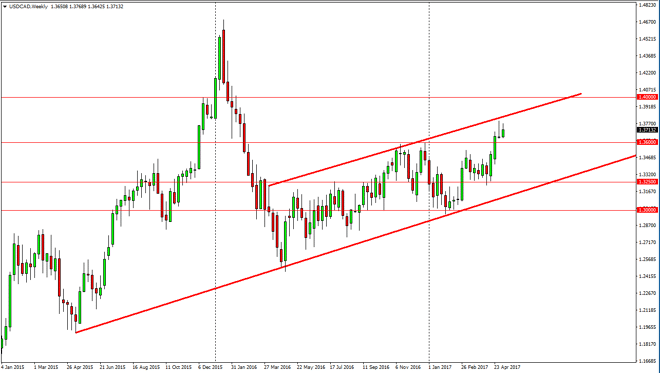

USD/CAD forecast for the week of May 15, 2017, Technical Analysis

Updated: May 13, 2017, 05:31 GMT+00:00

The USD/CAD pair broke higher during the week, testing the top of the shooting star from the previous week. The 1.36 level underneath will continue to be

The USD/CAD pair broke higher during the week, testing the top of the shooting star from the previous week. The 1.36 level underneath will continue to be supportive, and that being the case it’s likely that the market could find quite a bit of volatility in this area. If we break down below the 1.36 handle, then I think that we drop down to the 1.3250 level. I have a channel drawn on the chart, and it looks very likely that we will continue to see that be and obeyed if we can break down. On the other and, if we can break above the top of the channel line, and more importantly the shooting star, the market should then go to the 1.40 level above, which will be resistive as well.

The influence of oil

The influence of crude oil cannot be underestimated, so we must see what happens next. If the oil markets rollover, then I think we are more than likely going to see an impulsive moved to the upside. Longer-term, I still believe in the uptrend of this market, and I think that pullbacks will continue to offer value given enough time. However, we could have a significant amount of down movement before then, so keep that in mind. Ultimately, I think that the US dollar will continue to be favored as although oil made a bullish move recently, the reality is that it is running into a significant amount of resistance. We may have to pull back to build up the momentum, but longer-term nothing has changed on this chart although we could see a little bit of a struggle in the short run. The oil markets must be monitored.

USD/CAD Video 15.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement