Advertisement

Advertisement

USD/CAD forecast for the week of May 22, 2017, Technical Analysis

Updated: May 20, 2017, 04:23 GMT+00:00

The USD/CAD pair broke down a bit during the week, breaking below the 1.36 handle. Part of this would be due to the fact that oil started to rally again,

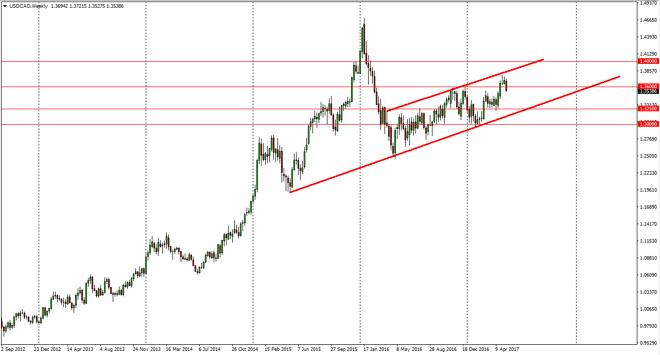

The USD/CAD pair broke down a bit during the week, breaking below the 1.36 handle. Part of this would be due to the fact that oil started to rally again, as it appears that OPEC will extend production cuts, and possibly even deepen them. That of course helps the Canadian dollar and drives up demand. That being said, it’s hard not to notice that we were at the top of the channel, so technically speaking we probably should’ve fallen anyway. Now that we broke below the 1.36 handle, it’s likely that we will go looking for support below. I believe that the 1.3250 level should be supportive, and therefore I’m looking for some type of buying opportunity below for longer-term move. Obviously, oil will have a significant influence on what happens next, and of course there are a lot of moving pieces when it comes to that market.

Still in an uptrend

We are still in an uptrend, and I don’t forget that. So I’m waiting to see when the buyers return. I think that the move higher in oil will probably be short-lived, because it is based upon speculation that OPEC will not only extend the production cuts, but perhaps deepen them. However, higher prices will only bring in Americans and Canadians when it comes to drilling. Because of this, I think that the oil markets can only go so far to the upside. Also, we are starting to see significant problems with the Canadian housing market, specifically lending. Because of this, I think that the Canadian dollar will continue to soften over the longer term. Supportive daily candles could be used as buying opportunities as well, and most certainly the uptrend line of the channel will be.

USD/CAD Video 22.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement