Advertisement

Advertisement

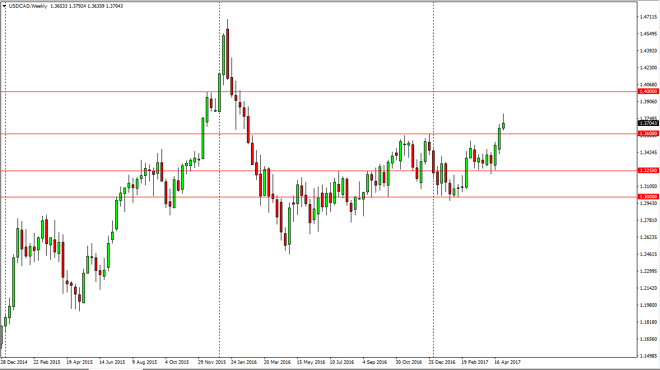

USD/CAD forecast for the week of May 8, 2017, Technical Analysis

Updated: May 6, 2017, 05:07 GMT+00:00

The US dollar climbed against the Canadian dollar during the week, but on Friday got a bit of a surprise jobs number that was stronger than anticipated.

The US dollar climbed against the Canadian dollar during the week, but on Friday got a bit of a surprise jobs number that was stronger than anticipated. Because of this, the market looks as if it is buying oil to anticipate more demand. Quite frankly, there are huge issues out there for oil so I feel that the strength in the petroleum markets are only going to be a short-term phenomenon. This of course help the Canadian dollar during the session on Friday which ended up forming a bit of a shooting star for the weekly candle. Nonetheless, I think the 1.36 level below will be supportive and it’s only a matter of time before the buyers return. After all, the employment situation in Canada isn’t exactly hot as they missed the employment figures on Friday.

Buying dips

I continue to think that buying dips in this pair is probably the prudent thing to do, and would expect this market to find buyers below, especially near the 1.360 level. If the oil rally turns around, and I anticipate it will somewhere near the $47 level, that should turn this market to the upside as well. I still think that the 1.40 level above will be targeted, but it might take a while to get there. The market has seen plenty of impulsivity just below, and I think that will return over the next several sessions. Because of this, I am not interested in selling, I think the market would have far too much to chew through in order to make that a viable trade. Alternately, if we break above the top of the range for the week, that would be a very bullish sign that we are heading towards 1.40 level much quicker than anticipated.

USD/CAD Video 08.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement