Advertisement

Advertisement

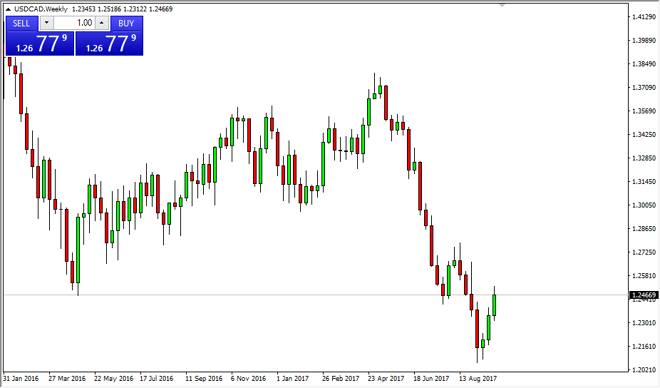

USD/CAD forecast for the week of October 2, 2017, Technical Analysis

Updated: Sep 30, 2017, 05:19 GMT+00:00

The USD/CAD pair rallied during the week, breaking above the 1.25 level at one point, but this is an area that I expect to see a lot of resistance at. We

The USD/CAD pair rallied during the week, breaking above the 1.25 level at one point, but this is an area that I expect to see a lot of resistance at. We have recently broken down below and uptrend line on the weekly chart, now I think were testing that area. We could find ourselves rolling over from here, and if we do at that we have much further to go. I would suspect that we would go to at least 1.21 level next, and I believe that at that point, the 1.20 level would be all but assured. However, if we managed to break above the 1.27 level, that would be very bullish for the US dollar. Keep in mind that the oil markets of course have an influence on the Canadian dollar, but recently I think most of this has been due to the bond trade more than anything else. Bond traders have been shorting US bonds, while buying Canadian bonds. This has a massive amount of money flowing back and forth across the border, and that of course has a massive effect on the Forex markets.

I expect a lot of volatility, but quite frankly after this massive selloff, even this rally doesn’t surprise me as when looked at under the prism of a weekly chart, there’s not much to see here. I believe that it’s likely we will see the sellers come back into this market, but we need to see a bit more stability. Recently, the Bank of Canada suggested that they weren’t sure when they were going to raise interest rates again, and that has caused a bit of this rally. However, I think the Federal Reserve is waffling as well, so expect a lot of noise here.

USD/CAD Video 02.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement