Advertisement

Advertisement

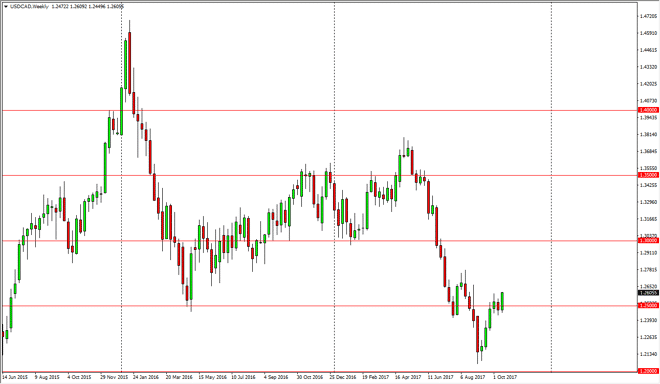

USD/CAD forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:21 GMT+00:00

The US dollar rallied during the week, slicing through the 1.26 level on Friday against the Canadian dollar. This is a very bullish sign, and should send

The US dollar rallied during the week, slicing through the 1.26 level on Friday against the Canadian dollar. This is a very bullish sign, and should send this market towards the 1.28 level above. If we can clear that level, then I think the next obvious target will be the 1.30 level, which of course is a large, round, psychologically significant number. The look of the candle is very healthy, and I think we will now start to find plenty of support at the 1.25 level underneath. Longer-term, you should pay attention to the oil markets, because they have a massive amount of influence on the Canadian dollar. At the same time, we have the likelihood of a hawkish Federal Reserve Chairman coming out of Washington DC, and that has been part of what has put a bid under the dollar.

I think that pullbacks of this point should be thought of as buying opportunities, unless of course we break down below the 1.24 handle, which would show significant negativity. A breakdown below there should send this market to the 1.21 handle underneath, which has been supportive in the past. I think that the market continues to be choppy overall, but I think that we are to continue to see a bit of strength going forward, and it’s likely that the US dollar continues to get a bit of a bid around the world. If that’s the case, and oil roles over big, that’s the perfect combination for this pair to rally from here, and reach to higher levels. Ultimately, I have no interest in trying to sell this market until we break down, as the candle for the week has been so strong and positively bullish. Otherwise, I fully anticipate that if you are patient enough, you should see the market rally.

USD/CAD Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement