Advertisement

Advertisement

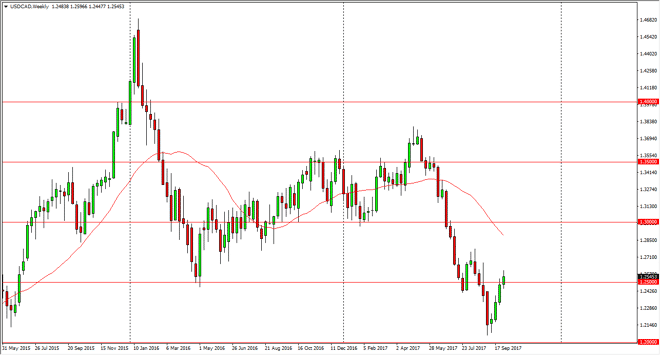

USD/CAD forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:29 GMT+00:00

The USD/CAD pair rallied during the week, breaking above the 1.25 level and even reached as high as the 1.26 level. This is an area of conflict from what

The USD/CAD pair rallied during the week, breaking above the 1.25 level and even reached as high as the 1.26 level. This is an area of conflict from what I can see, but given enough time I anticipate that the market is probably going to go looking towards the 1.2750 level. We had recently seen a very interesting bond trade in this market, as traders were buying Canadian bonds in shorting American once. However, it looks as if the bond trade is unwinding as the treasury markets are seeing higher rates. Higher rates of course should attract money towards America, and away from Canada. I think that the oil markets selling off of course will cause a bit of issue with the Canadian dollars well, so I think that we will probably see this market break out to the upside. However, a breakdown below the 1.24 level would be negative enough for me to expect this market to reach towards the 1.20 level underneath.

I think this will be a volatile trade, but we have seen a significant bounce, so a continuation of the move higher is what my base case is currently. A break above the 1.2750 level would be a very bullish sign, and should send this market to the 1.30 level after that. Once that happens, the market will probably continue much higher as it would be an extraordinarily strong sign and a market that has sold off so drastically. I think that this is going to be one of the more interesting pairs for Q4, and one that should be paid attention to. I am currently bullish, but I also recognize that we are going to see a lot of noise in this general vicinity.

USD/CAD Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement