Advertisement

Advertisement

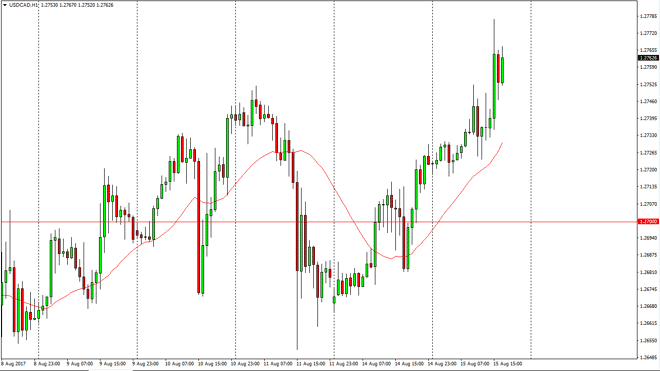

USD/CAD Price Forecast August 16, 2017, Technical Analysis

Updated: Aug 16, 2017, 04:22 GMT+00:00

The US dollar rallied significantly during the Tuesday session against the Canadian dollar, as we continue to see bearish pressure on the oil markets.

The US dollar rallied significantly during the Tuesday session against the Canadian dollar, as we continue to see bearish pressure on the oil markets. Because of this, I believe that the market is going to continue the break out as we are clearly above the 1.2750 level, which was the previous high. However, today is Crude Oil Inventory day, so that could have a lot of influence on where this pair goes next. Remember, the Canadian dollar is a proxy for crude oil, so if that number ends up being very bullish for crude oil, that could turn things back around. However, a stronger than anticipated retail sales figure for the session of course has put a lot of bullish pressure into the US dollar.

Inventories

I think the next move will be due to the crude oil inventories announcement, so it’s likely that we may sit still between now and then. However, given enough time I think that the general upward proclivity of the market will continue, and that we should go looking towards the 1.28 level next. Because of this, I am buying short-term debts, but recognize we could get a lot of noise right around that announcement in New York early morning trading. I currently believe that the 1.27 level below is going to offer a bit of a “floor” in the market. Because of this, I remain optimistic for the US dollar and think that we are starting to see a turnaround, least against some of the commodity currencies and especially against Canada which has a whole host of its own issues, not the least of which is housing and crude oil prices. Expect volatility, but I still expect the buyers to return unless the oil market turned around completely.

USD/CAD Video 16.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement