Advertisement

Advertisement

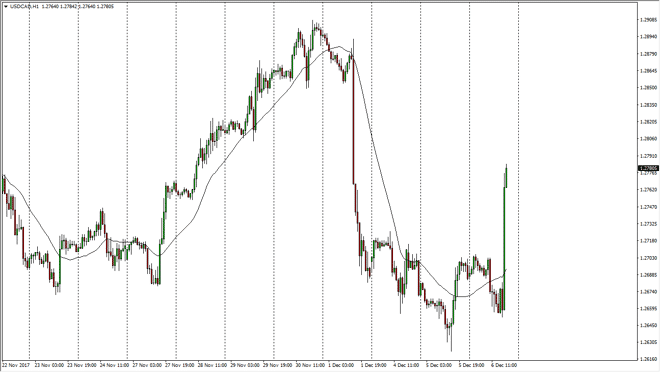

USD/CAD Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:01 GMT+00:00

The US dollar initially drifted lower during the trading session on Wednesday, but found enough support at the 1.2650 level to rally as the Bank of Canada sounded a bit dovish.

The US dollar rallied against the Canadian dollar during the trading session after initially dipping on Wednesday, as the Bank of Canada sounded a bit more dovish than perhaps traders thought. It looks as if we are going to continue to go higher, and as the Bank of Canada essentially suggested that rate hikes are off the table now, markets will start to pay attention to the Federal Reserve, and the likelihood that we will see interest rates rising in the United States. Ultimately, this market should continue to be a buying opportunity, and a short-term pullback should be an opportunity to pick up a bit of value underneath, and offer the momentum building opportunity to drive this market towards the 1.29 level above.

Ultimately, I believe that the market will then go to the 1.30 level above, which of course is very important, as it is psychologically important. A break above there then allows the market to go much higher. In general, I am very bullish of the US dollar against Canadian dollar because not only do we have an interest rate differential between the 2 economies, but we also have the crude oil markets looking very likely to struggle going forward, and that of course works against the value of the Canadian dollar longer term. After this reaction, it’s very likely that we will see a continued upward pressure over the longer term. Expect volatility, but it’s obvious to me that the uptrend that we have seen over the last several months should continue to be the main driver of where we go technically.

USD/CAD Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement