Advertisement

Advertisement

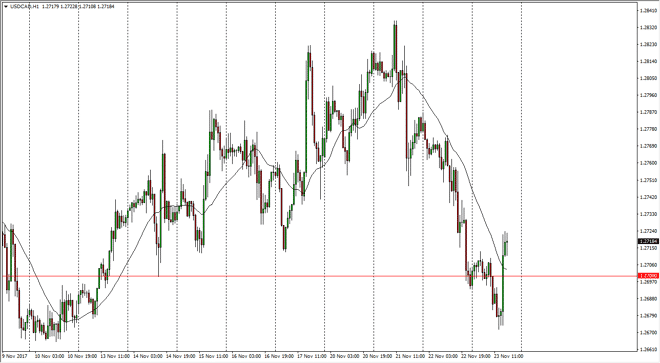

USD/CAD Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:04 GMT+00:00

The US dollar was initially sideways against the Canadian dollar during the trading session on Thursday, bouncing around the 1.27 level. We broke down

The US dollar was initially sideways against the Canadian dollar during the trading session on Thursday, bouncing around the 1.27 level. We broke down slightly, but then broke well above that level again. I think a lot of the move was due to the lack of volume when it comes to the pair, as the Thanksgiving Day holiday would have Americans away from their desks, giving us an opportunity to move the markets with very little in the way of volume. I look at this market is one that should continue to rally though, and I look at dips as potential buying opportunities, especially after the impulsive green candle on the hourly chart. As we have seen a significant pullback lately, the 1.27 level is an area that I’ve been paying attention to for some time, and I think that the area should lead to the 1.30 level, especially if the crude oil market roles over for any reason.

Remember the correlation between the WTI Crude Oil market and the Canadian dollar remain strong, and in verse from the USD/CAD pair. I think that we will go looking towards the 1.28 level next, but we need to be careful about putting too much money into the market in one trade, and I believe that it’s probably best to simply add slightly as we go along. Longer-term, I look at the 1.30 level is the target, but it is going to take a while to get there. This is especially true considering that there are lot of back and forth type of traders in the oil markets, which of course the Canadian dollar is a proxy for. Interest rates rising in the United States should continue to lift this market, and of course I am paying attention to the housing bubble in the Toronto area.

USD/CAD Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement