Advertisement

Advertisement

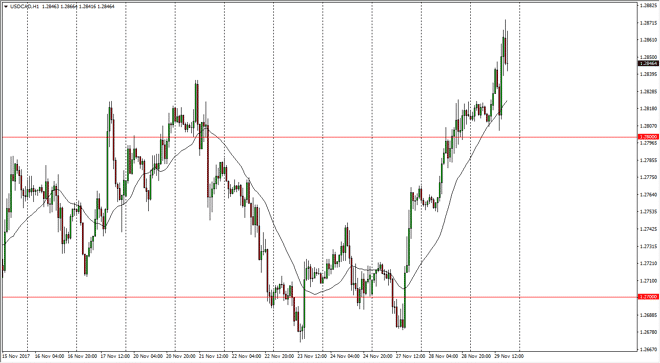

USD/CAD Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:04 GMT+00:00

The US dollar initially went sideways against the Canadian dollar during the trading session on Wednesday, but found enough support at the 1.28 level to

The US dollar initially went sideways against the Canadian dollar during the trading session on Wednesday, but found enough support at the 1.28 level to continue going higher, and reached towards the 1.2850 level. With the Crude Oil Inventories number coming out a little bit more bullish than anticipated, we did get an initial pull back, but the 1.28 level has been proven to be supportive. Because of this, I think that the market will eventually go much higher, perhaps reaching towards the 1.30 level over the longer term. This pair tends to be rather choppy regardless of this scenario, because quite frankly the 2 economies are so highly intertwined. The fact that we turned around and rallied again suggests that perhaps something in the distillate sector had traders concerned, and of course a lot of the drawdown could have been due to the large Thanksgiving weekend.

At this point, I suspect that the market has already made up its mind that it is going to go higher, and therefore I feel that the 1.30 level is probably somewhat a given at this point. The 1.28 level holding is necessary though, so think of that as the “floor” of an uptrend. Given enough time, we should try to break above the 1.30 level, which would be a bullish sign, and a sign of the next leg higher. Ultimately though, I think that the market will struggle to get through there, and it might take a little while to get the necessary clearance. Once we do though, I think we continue the longer-term uptrend that we have seen for a while, and it’s only a matter of time before the US dollar continues to rally based upon interest rate differential and interest rate outlooks in America.

USD/CAD Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement