Advertisement

Advertisement

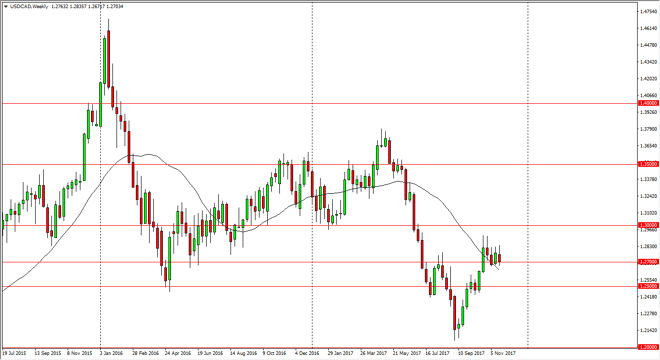

USD/CAD Price forecast for the week of November 27, 2017, Technical Analysis

Updated: Nov 25, 2017, 05:21 GMT+00:00

The US dollar initially rallied against the Canadian dollar during the week, but found enough trouble to turn around and form a bit of a shooting star.

The US dollar initially rallied against the Canadian dollar during the week, but found enough trouble to turn around and form a bit of a shooting star. The 1.27 level underneath continues to be supportive though, so I think that we will struggle to break down. However, if we break down below the range of the week, the market should continue to reach down towards the 1.25 handle. In general, I believe that the market is going to remain volatile, and you should keep in mind that the oil markets have a major influence on this pair. If oil continues to rally, we could see this market break down, as the Canadian dollar is highly correlated to the value of petroleum. Alternately, if the oil markets breakdown, we could see a search higher in this pair. Longer-term, I believe that the buyers will probably return to this market, and even if we break down I think that the 1.25 level underneath will be massively supportive, as we have recently made a “higher high.”

In general, I think that the market will continue to be very choppy, but that’s typical for this pair. Also, you should keep in mind that Thursday and Friday were a lot less liquid than usual, so I may not be as concerned about the candle shape. In general, the market continues to move around based upon not only oil, but the lack of Congressional success at tax bills. The Canadian housing market is a bit of a concern though, so I think that is working against the value of the Canadian dollar simultaneously. Because of this, I think the volatility is here to stay. On a break above the top of the range for the week, I suspect that be an even bigger fight at 1.30 above.

USD/CAD Video 27.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement