Advertisement

Advertisement

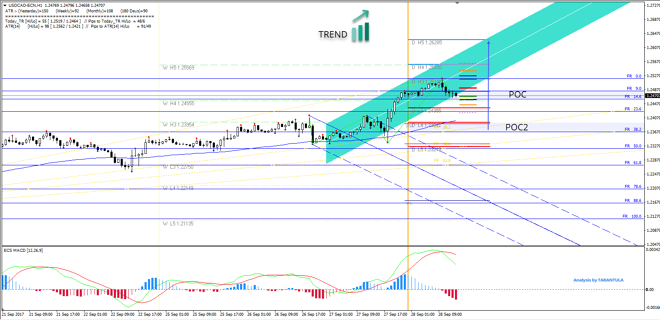

USD/CAD Uptrend Intact as long as 1.2325 holds

By:

The USD/CAD is in a strong uptrend. However traders need to pay attention to Trade balance data release today which measures the difference in value

The USD/CAD is in a strong uptrend. However traders need to pay attention to Trade balance data release today which measures the difference in value between imported and exported goods during the reported month. From the current standpoint 1.2455-70 is the POC zone ( PPC, W H4, ATR pivot, 14.6) and during strong trend 14.6 is known to reject the price. However on a deeper retracement that might happen after the news depending on the actual result, the USD/CAD could drop to POC2 (D L4, previous week’s high, EMA89, 38.2, W H3) 1.2370-95. Targets on a bounce are 1.2560 and 1.2630. 1.2325 needs to hold.

W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC – Point Of Confluence (The zone where we expect price to react aka entry zone)

Follow @TarantulaFX on twitter for latest market updates

Sign up for Live Trading Webinars with Nenad Kerkez T

Connect with Nenad Kerkez T on Facebook for latest market update

About the Author

Nenad Kerkezcontributor

M.Ec. Nenad Kerkez aka Tarantula is Elite CurrenSeas Head trader and a valued contributor to many premium Forex and trading websites.

Advertisement