Advertisement

Advertisement

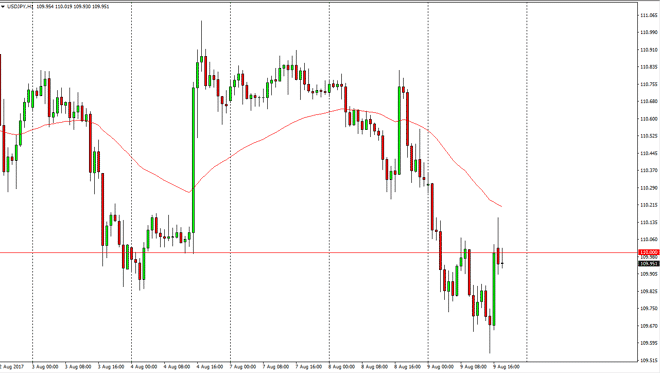

USD/JPY Forecast August 10, 2017, Technical Analysis

Updated: Aug 10, 2017, 06:21 GMT+00:00

The US dollar was very choppy against the Japanese yen during the Wednesday session as fears over conflict on the Korean Peninsula hit the markets. We

The US dollar was very choppy against the Japanese yen during the Wednesday session as fears over conflict on the Korean Peninsula hit the markets. We break down below the 110 level, which of course is a very psychologically important level, and have now tested that area a couple of times. It looks as if we are going to continue to see sellers in this market, but if we can break above the 110.25 level, I think at that point the market will begin to rally a bit more significantly. Otherwise, we will probably get down to the 109 level over the next several sessions.

Caution, not panic.

I believe that the market is showing a certain amount of caution as the Japanese yen is considered to be a safety currency. However, it’s really not much of a panic, as the worst selloff was about 70 pips. Because of this, I think we are to see in a gentle grind lower, and that will more than likely continue to be the case as the safety bid continues to be what the market likes.

USD/JPY Video 10.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement