Advertisement

Advertisement

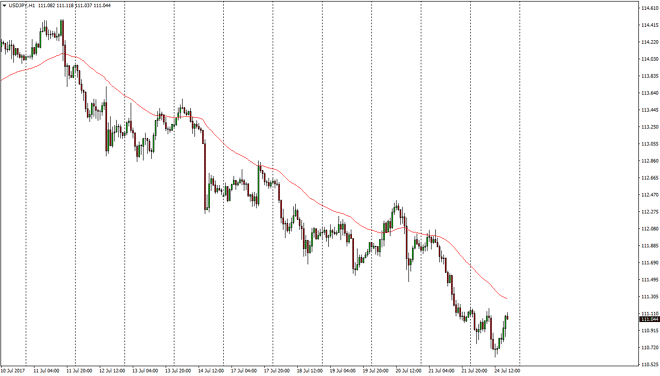

USD/JPY Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:14 GMT+00:00

The USD/JPY pair fell initially during the day on Monday, within rallied a bit. It fell again, and then rallied again. It looks as if we are trying to

The USD/JPY pair fell initially during the day on Monday, within rallied a bit. It fell again, and then rallied again. It looks as if we are trying to make some type of stand near the 111 level, which would make sense as it is a large, round, psychologically significant number. However, the markets found the 111 level to offer a bit of resistance, and it looks as if we are trying to pull back again. I believe that the real support is probably closer to the 110 level, so this attempt to rally may fail. Pay attention to the equity markets, because if they start to sell off that could add more pressure to this market. In general, the US dollar is falling against most currencies around the world, so would not be a surprise at all to see the dollar yen pair fall a bit.

Selling rallies?

I believe that selling short-term rallies might be the best way to go, least on signs of exhaustion. A breakdown below the 110.80 level could open the door to the 110.50 level again, but I think that the volatility is probably going to be something that you will have to deal with, at least in the short term. Yes, the US dollar has been sold off drastically, and perhaps it is due for a bounce, but it looks as if the bearish pressure has certainly accelerated in this market overall, and it generally does that for a reason. It looks as if the Federal Reserve may not be able to raise interest rates as quickly as once thought, and that of course has a massive influence on this market. One thing I think you can count on is a very choppy condition set up in this market.

USD/JPY Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement