Advertisement

Advertisement

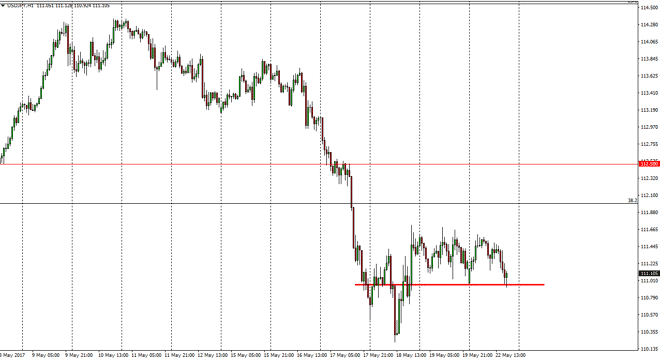

USD/JPY Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:06 GMT+00:00

The USD/JPY pair initially gapped lower at the open on Monday, but then shot higher towards the 111.65 level. This has been the top of recent

The USD/JPY pair initially gapped lower at the open on Monday, but then shot higher towards the 111.65 level. This has been the top of recent consolidation, and the fact that we reach that area and pulled back should not have been a huge surprise as the market has been so tight as of late. Ultimately, we rolled back over and found support again at the 111 level, and that’s an area where the buyers seem to be interested in coming back into the market. I think ultimately that the market is going to remain choppy due to all the geopolitical headwinds around the world. Remember, this pair tends to be very risk sensitive, so it makes sense that it will remain volatile. With that being the case, I believe that playing the short-term range of roughly 70 pips will probably be the best way to go.

Tight stops

I believe that you will have to use tight stops, because of the potential of a headline crossing the wires that throws the market into disarray. If we broke down below the 111 level, I think the market will then go looking for support near the 110 handle. If we can break above the 111.65 handle above, the market should then go to the 112.50 level. Ultimately, this is a market that shows signs of volatility overall, so none of these moves should be difficult to fathom or surprising. If we can break above the 112.50 level, the market will continue to go much higher, but that is more of a longer-term move. In the meantime, I assume that the market continues the consolidation that we have seen over the last couple of sessions and therefore I look for short-term opportunities more than anything else.

USD/JPY Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement