Advertisement

Advertisement

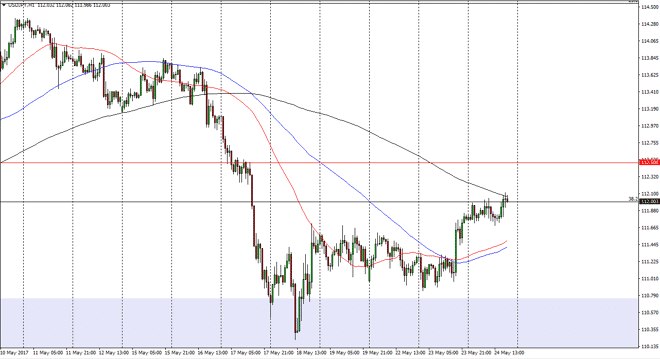

USD/JPY Forecast May 25, 2017, Technical Analysis

Updated: May 25, 2017, 03:48 GMT+00:00

The USD/JPY pair had a quiet session during the day on Wednesday, as we continue to see the 112 level offer resistance. I believe that there is a “zone”

The USD/JPY pair had a quiet session during the day on Wednesday, as we continue to see the 112 level offer resistance. I believe that there is a “zone” of resistance all the way to the 112.50 level above. It’s not until we break above there that I’m comfortable buying, and I believe a pullback is likely in the short term. However, I think that there should be support near the 111.50 level, so we should see a bit of volatility. Remember, this pair tends to be volatile overall but I think that the market has plenty of buyers underneath, and eventually we will break out. However, you will probably be looking for short-term trades at best, as the move will continue to offer opportunities in both directions.

Two speed market

In my estimation, this is a 2 speed market as short-term traders will drop from here, but I think longer-term there is a lot of support underneath that should attract longer-term traders. Ultimately, the market will hinge on headlines, as there are a lot of political concerns around the world. As a general rule, as stock markets and markets in general feel comfortable, this market should continue to go higher as it shows a “risk on” attitude in the market, and therefore the Japanese yen being sold is a good sign for other markets. In the meantime, we will probably be looking at an opportunity to trade smaller positions as it will be easy to lose quite a bit of money on a shock announcement or headline. I believe that the longer-term grind to the upside will continue, but you will have to be able to “hold your nose” and deal with the volatility. Again, it all comes down to the time frame that you are looking to trade.

USD/JPY Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement