Advertisement

Advertisement

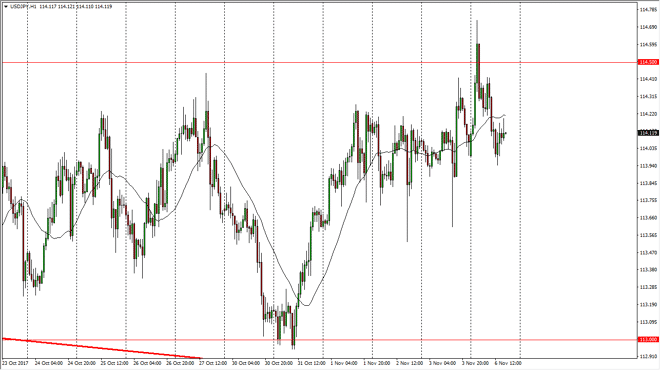

USD/JPY Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 07:00 GMT+00:00

The US dollar initially rallied against the Japanese yen, breaking above the $114.50 level. However, we rolled right back around at that level, which of

The US dollar initially rallied against the Japanese yen, breaking above the $114.50 level. However, we rolled right back around at that level, which of course is an area that defines massive resistance. That resistance extends to the 115 handle, and a break above the 115 level would be a major event. I believe that short-term pullbacks should continue to be buying opportunities, and eventually we should break out. As I have been paying attention to the 10-year notes in America, interest rates are starting to rise, and that of course helps this pair go higher, as the US dollar strengthens against the yen due to demand. I believe that the 114 level is currently offering short-term support, but I think there is even more support down at the 113 level.

Volatility will continue to be an issue in this pair, as it typically is. The market has recently broken above a downtrend line on the weekly chart, and although there should be a lot of noise, I like the idea that pullbacks offer an opportunity to pick up value in the US dollar, as it will only be a matter of time before we break out to the upside. Once we break above the 115 handle, the market should then go looking towards the 118 level, an area that has been resistive in the past. Ultimately, this is a market that should continue to be noisy, but I get the idea that it’s going to take a significant amount of work to go higher. Because of this, building a position slowly is probably the best way to trade this market, as the momentum needed to breakout above the 115 level will probably be quite strong. If we were to break below the 113 level, that would be a very negative sign indeed.

USD/JPY Video 07.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement