Advertisement

Advertisement

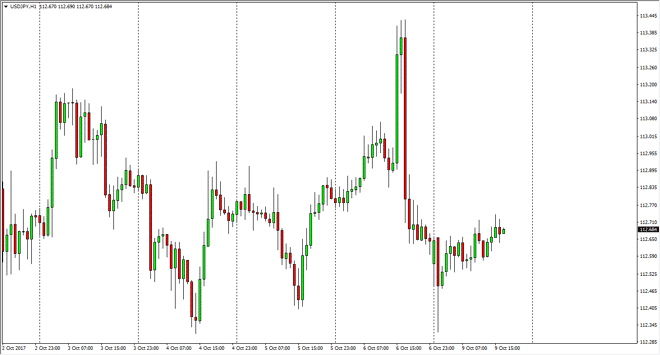

USD/JPY Forecast October 10, 2017, Technical Analysis

Updated: Oct 10, 2017, 05:05 GMT+00:00

The US dollar rallied slightly against the Japanese yen on Monday, as we are grinding a bit, trying to form a base at the 112.50 level again. I think

The US dollar rallied slightly against the Japanese yen on Monday, as we are grinding a bit, trying to form a base at the 112.50 level again. I think there is a significant amount of support just below and extending to the 112 level, so I think that short-term traders will probably be buyers. However, I think the more important question is the treasury markets and how they are going to react. Currently, looks to me as if interest rate differential will continue to favor the United States, and therefore the longer-term attitude of this market should be to grind to the upside. Obviously, a large part of the selloff was due to the less than anticipated jobs number, but they were a bit skewed due to the hurricanes that had hit the United States in September. With that in mind, I think that eventually traders will write off that entire situation, and therefore send this market back to the upside.

The other reason that the market fell was the threat of North Korea to test a missile that could reach the western part of the United States over the weekend. Things have subsided a bit, and quite frankly the duration of these knee-jerk reactions is continuing to fall after each one of these announcements. Because of this, I think it will have a limited effect on what this market does next, so therefore I believe that we will go looking towards the 113.25 level again. That’s not to say that we can’t dip from here, but I just think that there is enough support underneath that we will eventually find buyers to jump back into the market and therefore it’s probably best to be patient with this pair as we try to build confidence again.

USD/JPY Video 10.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement