Advertisement

Advertisement

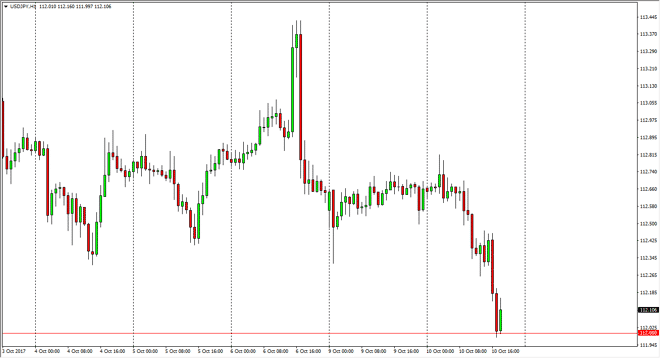

USD/JPY Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 05:25 GMT+00:00

The US dollar fell apart against the Japanese yen during the trading session on Tuesday, as we got a bit of a “risk off” type of day. However, the 112

The US dollar fell apart against the Japanese yen during the trading session on Tuesday, as we got a bit of a “risk off” type of day. However, the 112 level looks as if it is trying to offer support, so I think it’s only a matter of time before the buyers get back involved and push this market to the upside. I recognize that a breakdown from this level should send this market to the 111-level underneath, which is even more supportive. We have recently seen a very bullish move in this pair, so it makes sense that we may have to pull back a little bit to build up momentum. That momentum should continue to pick up, and reached towards higher levels. We have been consolidating longer-term, and the 114.50 level above has been massively resistive.

Short-term pullback should be buying opportunities, and I think that we will eventually break out to the upside, especially if the FOMC Meeting Minutes continue look bullish. If we can break out above the 115 handle, the market should then go to the 120 level after that. Ultimately, this is a market that is highly sensitive to the interest rate differentials between the US and Japanese bond markets, and as interest rates rise, this pair should continue to go to the upside. Ultimately, this is a market that I think will continue to find a lot of volatility, but I think that we have a lot of noise ahead of us. If we did breakdown, then I would be looking for support near the 111-level underneath, as it would be an excellent opportunity to pick up value in a pair that can take off rather significantly. I have no interest in selling anytime soon.

USD/JPY Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement