Advertisement

Advertisement

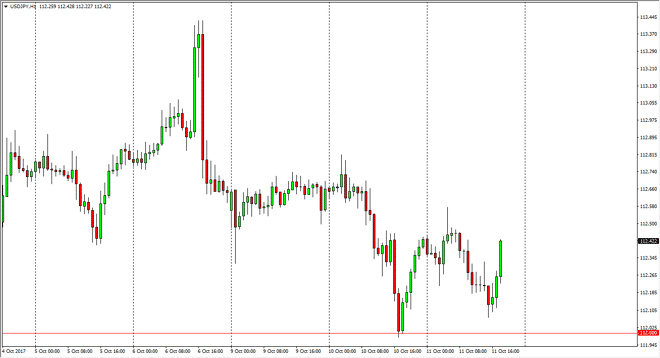

USD/JPY Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:54 GMT+00:00

The US dollar fell initially during the trading session on Wednesday, but found enough support just above the 112 level to turn things around and show

The US dollar fell initially during the trading session on Wednesday, but found enough support just above the 112 level to turn things around and show signs of life. The US dollar should continue to find plenty of support at the 112 level, and I believe that every time we pull back, there will be plenty of support in that area. In fact, I believe that it should offer a bit of a “floor.” However, if we were to break down below there, then I recognize that there is a massive amount of support underneath at the 111 level. Because of that, I think it’s only a matter of time before the buyers return, unless of course the FOMC Meeting Minutes explicitly tells us that the Federal Reserve has no interest in raising interest rates.

Having said that, I think that there’s a certain amount of posturing that the Federal Reserve should do now. They have been talking about raising rates for some time now, so I think that the market needs to see them follow through on this, or they will lose credibility. The question now becomes how many times do they raise interest rates, and that’s probably what most people will be looking for in the Meeting Minutes. Because of that, I think it’s only a matter of time before we get a little bit of clarity, but I think that the idea is already planted in the marketplace, so I suspect that any reason to rally will be jumped upon. The Bank of Japan continues to look very soft, and therefore it makes sense that we do reach towards the 114.50 level, which has been the top of the longer-term consolidation that we are stuck in. Ultimately, this is a “buy only” market for me.

USD/JPY Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement