Advertisement

Advertisement

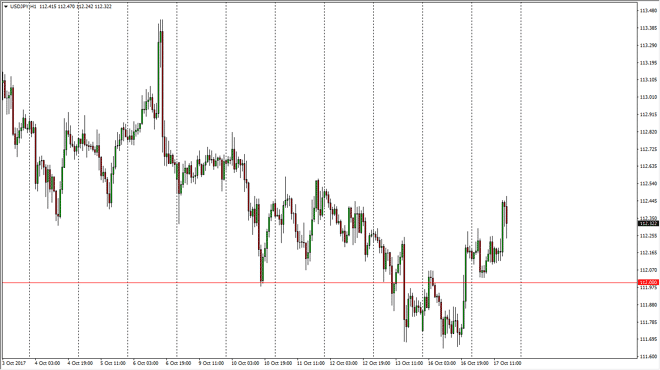

USD/JPY Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 04:54 GMT+00:00

The US dollar went sideways initially during the day on Tuesday, pulling back to test the 112 level for support. We did find that level supportive enough

The US dollar went sideways initially during the day on Tuesday, pulling back to test the 112 level for support. We did find that level supportive enough to cause a bounce, and it now looks as if the market is trying to break above the 112.50 level. There is a significant amount of support underneath, so I like buying dips, as the pair has been rallying lately. Beyond that, the treasury markets continue to see rising interest rates, and that of course helps the US dollar as well. Also, the USD/JPY pair tends to be very sensitive to stock markets, which are rallying as well. As long as that’s the case, it makes sense that the pair continues to rally. I recognize that there are a lot of noisy areas above, but the longer-term move is towards the 114.50 level above. I think that the market will eventually break above there, but obviously it’s going to take a while to get out of the longer-term consolidation.

Once we do break above there, the market is free to go much higher, as the 115 level being cleared, which I see is the top of the resistance at the top of consolidation, and perhaps we could go as high as 120. I believe that you should keep in mind that the “risk on” attitude should continue to help this market, and I also recognize that even if we break down below the 112 level, the market then has massive amounts of support near the 111 level, and therefore I think that this is a “buy on the dips” market regardless, and with that being the case, I have no interest in shorting. It’s going to be Bobby as this pair typically is, but I am a buyer.

USD/JPY Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement