Advertisement

Advertisement

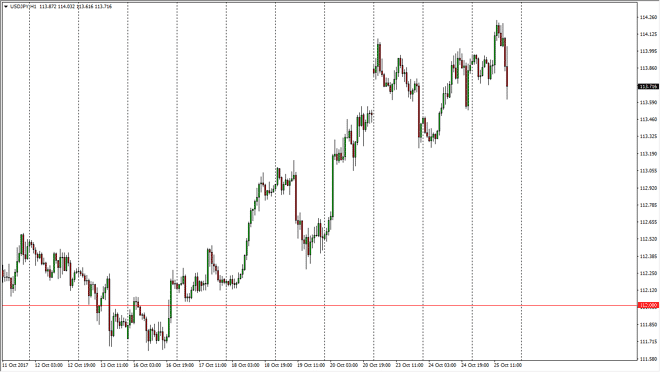

USD/JPY Forecast October 26, 2017, Technical Analysis

Updated: Oct 26, 2017, 04:35 GMT+00:00

The US dollar initially tried to go higher against the Japanese yen during the session on Wednesday, reaching towards the 114.25 handle. There is a

The US dollar initially tried to go higher against the Japanese yen during the session on Wednesday, reaching towards the 114.25 handle. There is a significant amount of resistance just above, and extending to the 115 handle. Because of this, although I think that the market will continue to go higher, it’s likely that we will see a lot of choppiness and potential pullbacks every time we get towards that area. Over the long run, I anticipate that the market will break above the 115 handle, and go much higher, perhaps extending to the 118 handle, and then the 120 handle. Longer-term, this is a market that I prefer to buy and not sell, because of the outlook for both central banks. The Federal Reserve is known to be hiking interest rates at least twice going forward, if not 3 times. On the other side of the Pacific Ocean, you of the Bank of Japan that will stay alter easy with its monetary policy, and the recent landslide election for Abe will only underpin the loose monetary policy that has been such a feature.

I think that the 112-level underneath continues to be the “floor” in the market, and between now and then any time we pull back, there should be a nice supportive candle that we can get involved in. I think that once we break above the 115 handle, then you can add to the position in much larger chunks, but in the meantime, I think it’s probably best to add slowly, and be careful with your account as the choppiness in this pair is a bit legendary. Longer-term though, this market has a long history of jumping around before getting some type of clarity after an overall trend change, which I feel we are in the middle of right now.

USD/JPY Video 26.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement