Advertisement

Advertisement

USD/JPY forecast for the week of July 10, 2017, Technical Analysis

Updated: Jul 8, 2017, 06:27 GMT+00:00

The USD/JPY pair rally during the week, slicing through the 113 level and then reaching towards the 114 level. This was exacerbated by the stronger than

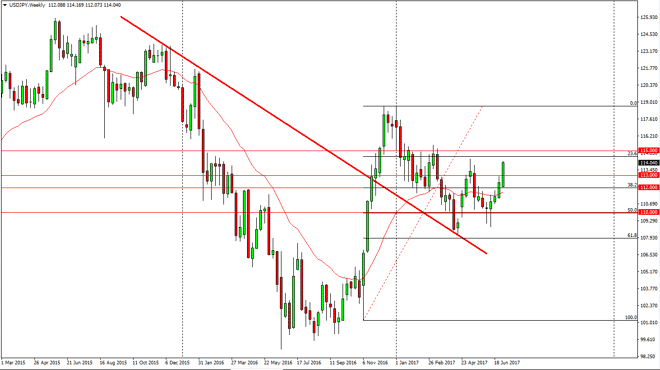

The USD/JPY pair rally during the week, slicing through the 113 level and then reaching towards the 114 level. This was exacerbated by the stronger than anticipated jobs number coming out of the United States, and of course the positive reaction around the world. That tends to favor this pair, as the Bank of Japan continues to be light years away from tightening monetary policy. Beyond that, the Japanese yen is a safety currency, so the fact that this rallied should not be much of a surprise. I believe that the 115 level above being broken is a longer-term “buy-and-hold” signal. In the meantime, I look at pullbacks as value, as I have for some time. The market should eventually go to much higher levels, but I also recognize that there will be a lot of volatility as headlines tend to move this market rather rapidly.

Hawkish Federal Reserve

With the Federal Reserve being hawkish, I think that is the most important thing to glean from the markets as to the direction of this pair, so therefore I don’t have any interest in shorting. Yes, this pair can be volatile but when you look at the longer-term chart you can see the technically everything has held up. Because of this, I believe that the 112 level below will be massively supportive as it was the bottom of this past week’s range, and I believe that eventually the buyers will be attracted to this market that are willing to hang on to the trade as it becomes a longer-term moved to the upside and perhaps a reclamation of the uptrend that we were trying to get involved with. Selling isn’t even a thought going forward in this currency market.

USD/JPY Video 10.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement