Advertisement

Advertisement

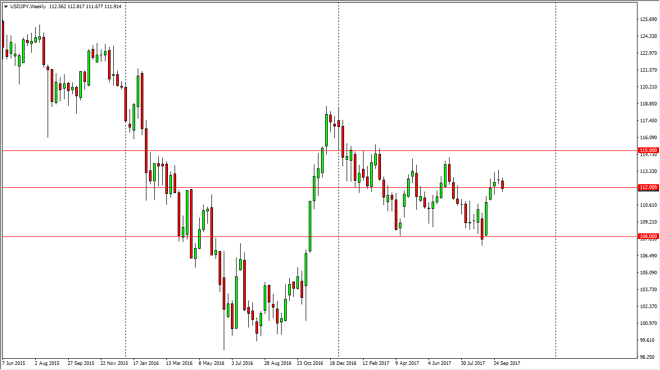

USD/JPY forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:32 GMT+00:00

The US dollar rolled over against the Japanese yen during the week, and somewhat of a tight range. We formed a shooting star during the previous week, and

The US dollar rolled over against the Japanese yen during the week, and somewhat of a tight range. We formed a shooting star during the previous week, and that of course is a negative sign. Breaking down below the 112 level is negative, but I think that at the end of the day, we have plenty of support below that could come back into play. I believe longer-term targeting of the 108 level is possible if we continue to go lower, but I also recognize that there’s a lot of noise. Interest rates had been rising in the United States, and that of course is good for the US dollar against the Japanese yen, especially when it shows up in the 10-year interest note markets. I think that if we break above the shooting star from the previous week, then the market is almost certain to go towards the 115 handle above. Breakout above there is a longer-term “buy-and-hold” move just waiting to happen.

I think that we are going to continue to see a lot of volatility in this pair, so longer-term traders may be a bit frustrated. I do think that there are buyers below, so a pullback at this point should end up being a nice opportunity to pick up value in a market that should continue to go higher over the longer term, after we had seen such an impulsive move late last year. This is classic trend changing attitude in this noisy market that we have seen every few years. This pair tends to be extraordinarily volatile, but if you could hang onto a position for the longer-term, it does pay well. If we did somehow break below 108, that negates everything but I don’t think that’s going to happen.

USD/JPY Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement