Advertisement

Advertisement

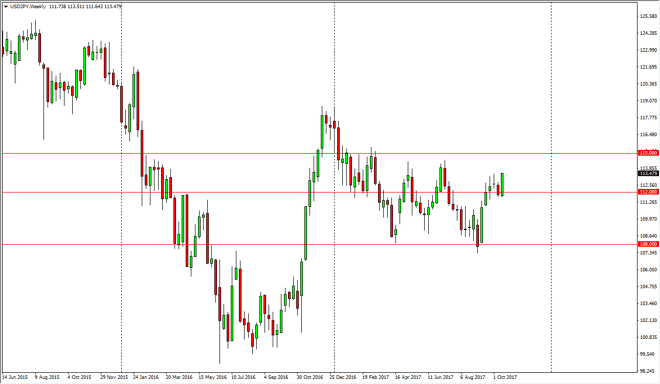

USD/JPY forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:21 GMT+00:00

The USD/JPY pair rallied during the week, using the 112 level as a bit of a springboard. As it looks like we are going to how hawkish Federal Reserve

The USD/JPY pair rallied during the week, using the 112 level as a bit of a springboard. As it looks like we are going to how hawkish Federal Reserve Chairman going forward, the US dollar has rallied significantly. One would expect the market to go back towards the top of the recent consolidation area, which starts at the 114.50 level. A break above the 115 level sends this market much higher, perhaps towards the 118 level after that. I believe that short-term pullbacks continue to be buying opportunities, and that the 112 level should offer a bit of a floor going forward. I also recognize that even if we break down below there, the market should then find plenty of buyers at the 111 level as well. The market will continue to be volatile, but I do think that the upward pressure continues as not only do we have the US dollar strengthening, but we also have stock markets behaving quite strongly.

Ultimately, this is a market that I think continues to be a “buy on the dips” opportunity, and eventually we do get a breakout that is necessary. Ultimately, the market continues to be noisy, but in the end, I think eventually we will see the currency pair rally, as both the Bank of Japan want it to happen, and it seems as if the risk appetite favors a move to the upside in general. That being said, it’s not necessarily going to be an easy trade to take, and adding slowly to your core position is probably the best way to play this market as we have seen so much supply above that continues to keep the market somewhat in check. Longer-term though, I fully anticipate that we break out.

USD/JPY Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement