Advertisement

Advertisement

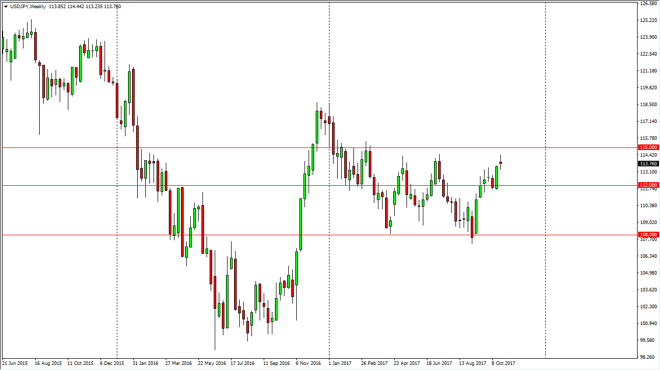

USD/JPY forecast for the week of October 30, 2017, Technical Analysis

Updated: Oct 28, 2017, 11:50 GMT+00:00

The US dollar was very volatile against the Japanese yen, going back and forth and forming a neutral candle. We are approaching a reasonably significant

The US dollar was very volatile against the Japanese yen, going back and forth and forming a neutral candle. We are approaching a reasonably significant resistance barrier at the 114.50 level, extending to the 115 level above. In fact, I would not be surprised at all to see a little bit of a pullback, perhaps an attempt to build up enough momentum to finally break out to the upside. It’s not until we clear the 115 level that I think longer-term buyers will be attracted to this market, unless of course we get some type a pullback that offers value, which of course is very possible. I think that the 112-level underneath is a very good candidate for support, so if we can stay above there, we should eventually build up enough momentum to finally go much higher, with the initial target being the 118.50 level.

Pay attention to the overall attitude of stock markets and of course risk appetite. The better off we are as far as that metric is concerned, the better this pair does. Keep in mind that the Federal Reserve is more than likely going to raise interest rates several times, and that should eventually put quite a bit of bullish pressure in this market. However, even with the overall bullish move that we have seen as of late, we are still in consolidation. The 108 level has been the bottom of it for some time, so if we do break down below the 112 level, I think at that point we probably go revisiting that area. However, I believe that the market is trying to build up enough momentum to finally leave this region and to the upside. Patience will be needed for some type of break out though.

USD/JPY Video 30.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement