Advertisement

Advertisement

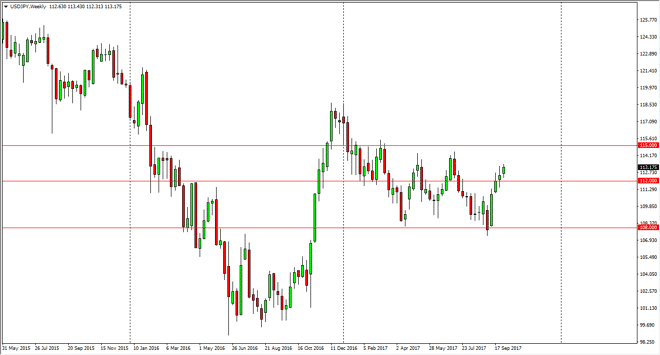

USD/JPY forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:29 GMT+00:00

The US dollar continues to show strength against the Japanese yen, as we are now clear of the 112 level, and trying to break above the 113 level.

The US dollar continues to show strength against the Japanese yen, as we are now clear of the 112 level, and trying to break above the 113 level. Longer-term, the market looks likely to test the top of the overall consolidation area near the 114.50 level, which extends to the 115 handle. Once we finally break that level, I think it becomes more of a “buy-and-hold” market. Until then, I think that it’s probably easier to trade from the short-term charts, but I still believe that we go higher regardless. It comes down to your risk appetite, but I believe that small positions and building on them as the market goes your way is probably the best way to trade this pair, and I believe that the interest rate differential will continue to expand between the United States and Japan. That will drive this pair higher, and if we get some type of “risk on” move, then the market should continue to go even higher.

I don’t have any interest in shorting, least not until we would break down below the 111 level, which is support on short-term charts. Ultimately, I think the market should continue to find buyers underneath, so I am more apt to start buying, especially considering how impulsive that we have been recently. It does look like we are running out of momentum though, so a pullback would necessarily be overly surprising. I think that this pullback should only be a momentum building opportunity, and therefore I will be looking for supportive candles on short-term charts to get involved, and most certainly would be a buyer on a break above the top of the weekly candle. I believe that we will eventually find a way to break out.

USD/JPY Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement